Table of Contents

In the realm of personal finance management, Mint.com has long reigned as one of the go-to tools for budgeting and tracking expenses. However, there comes a time when some users may find themselves seeking an alternative solution. Enter Excel – a versatile spreadsheet software that offers immense customization options and a powerful set of tools for financial analysis. In this comprehensive guide, we will explore the process of transitioning from Mint.com to Excel, weighing the pros and cons, and discovering the advantages Excel brings to personal finance management.

Understanding the Basics of Mint.com and Excel

What is Mint.com?

Mint.com is a web-based personal finance management tool that allows users to track and categorize their expenses, set budgets, and monitor financial goals. It provides a holistic view of an individual’s financial health, consolidating information from different bank and credit card accounts. With its user-friendly interface and automated features, Mint.com has become a popular choice for individuals aiming to gain control over their finances.

One of the key features of Mint.com is its ability to analyze spending patterns and provide insights into where money is being allocated. By generating visual reports and graphs, users can easily identify areas where they may be overspending and make adjustments to their budget accordingly. Additionally, Mint.com offers personalized tips and recommendations to help users save money and reach their financial objectives faster.

The Fundamentals of Excel

Excel, on the other hand, is a powerful spreadsheet software developed by Microsoft. Originally designed for data analysis and manipulation, Excel has evolved into a versatile tool used for a wide range of tasks, including personal finance management. Users can create customized spreadsheets to track income, expenses, investments, and more. With its extensive features and flexibility, Excel offers individuals the opportunity to tailor their financial tracking to suit their specific needs.

Excel’s formulas and functions allow users to perform complex calculations and automate repetitive tasks, making it an efficient tool for financial analysis. From creating budgets to forecasting future expenses, Excel provides a robust platform for individuals to manage their finances effectively. Moreover, Excel’s integration with other Microsoft Office applications enables seamless data sharing and collaboration, making it a valuable asset for both personal and professional use.

Why Consider Switching from Mint.com to Excel?

Pros and Cons of Mint.com

Mint.com offers various advantages, such as its ability to automatically sync with financial accounts and categorize transactions. It provides users with a holistic snapshot of their financial situation, highlighting areas for improvement. However, Mint.com does have limitations. For instance, it may not support certain financial institutions or offer the level of customization some individuals desire. Additionally, some users may have concerns about data privacy and security when utilizing a third-party platform.

Moreover, Mint.com’s budgeting tools are user-friendly and can help individuals track their spending habits effectively. The platform also sends alerts for upcoming bills and unusual account activity, aiding in financial management. However, some users find the advertising within Mint.com to be intrusive and distracting, impacting the overall user experience. Despite these drawbacks, Mint.com remains a popular choice for many due to its convenience and accessibility.

Advantages of Using Excel for Personal Finance

Excel, on the other hand, provides complete control over personal finance tracking. It allows users to customize the layout, formulas, and calculations according to their preferences. With Excel, individuals can create personalized templates, charts, and graphs to visualize their financial data. Furthermore, as the data is stored locally, there is no need to worry about third-party access or privacy concerns.

Additionally, Excel offers advanced features for data analysis and forecasting, making it a versatile tool for financial planning. Users can create complex financial models, perform scenario analysis, and conduct in-depth budget reviews with ease. The flexibility of Excel allows for seamless integration of various financial data sources, providing a comprehensive overview of one’s financial health. Despite requiring more manual input compared to Mint.com, Excel’s robust capabilities make it a preferred choice for individuals seeking a high level of customization and analytical control over their personal finances.

Preparing for the Transition from Mint.com to Excel

Essential Excel Skills for Personal Finance Management

Before diving into Excel for personal finance management, it is essential to familiarize yourself with some key skills. Understanding basic formulas, functions, and data organization techniques will be invaluable as you embark on your financial tracking journey with Excel. Online tutorials, courses, and Excel forums can serve as valuable resources in acquiring these skills.

Moreover, mastering Excel shortcuts can significantly boost your efficiency when managing personal finances. Shortcuts like Ctrl+C for copying data, Ctrl+V for pasting, and Ctrl+Z for undoing actions can save you time and effort. Familiarizing yourself with these shortcuts will make navigating Excel smoother and more convenient.

Setting Up Your Excel for Financial Tracking

Prior to transitioning, it is essential to set up Excel for efficient financial tracking. Start by creating a designated worksheet or workbook to house your personal finance data. Consider the different categories you want to track, such as income, expenses, savings, and investments. Implementing clear and organized data entry formats will streamline the tracking process and allow for easy analysis in the future.

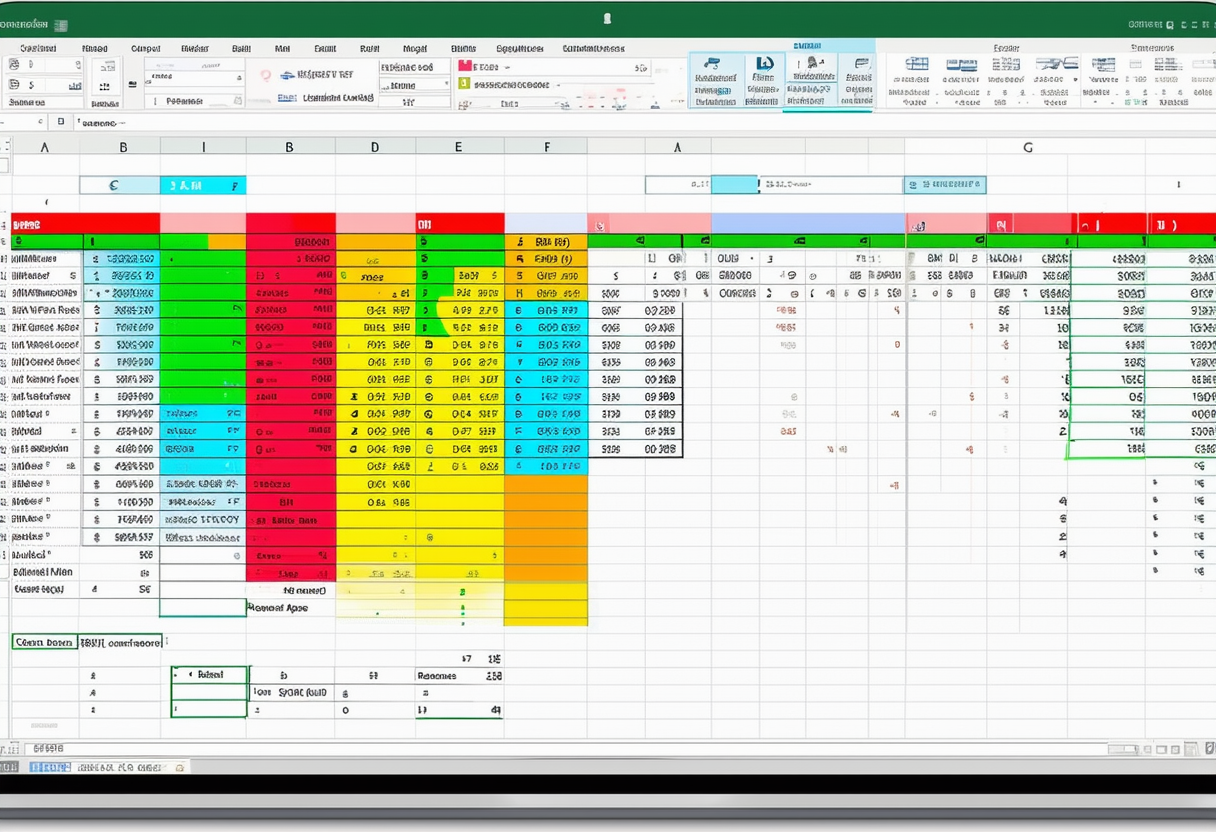

Furthermore, utilizing Excel’s conditional formatting feature can enhance the visual representation of your financial data. By setting up color-coded rules based on specific criteria, such as highlighting expenses that exceed a certain threshold or flagging irregular income patterns, you can quickly identify trends and outliers within your finances. This visual aid can provide valuable insights into your financial habits and aid in decision-making for future budgeting strategies.

Step-by-Step Guide to Replacing Mint.com with Excel

Exporting Your Data from Mint.com

The first step in transitioning from Mint.com to Excel is exporting your financial data. Mint.com offers features to export transactions, account balances, budgets, and other relevant information as a CSV (Comma-Separated Values) file. This file format can be easily imported into Excel, allowing you to retain your historical financial data even after leaving Mint.com.

Importing Your Data into Excel

Once you have exported the data from Mint.com, it is time to import it into Excel. Excel provides a straightforward process for importing CSV files, ensuring that your financial data is seamlessly transferred. Verify that the imported data is accurate and includes all relevant information before proceeding to the next steps in the transition process.

Organizing Your Financial Data in Excel

With your data successfully imported into Excel, the next step is to organize it to suit your financial tracking needs. Create separate sheets or sections for different categories, such as income, expenses, and savings. Utilize Excel’s features, such as filters and pivot tables, to analyze your data effectively. Remember to customize your spreadsheets to match your preferred tracking style and ensure easy navigation.

Customizing Excel for Personal Finance Management

Creating Personal Finance Templates in Excel

One of the standout advantages of using Excel is the ability to create personalized templates for personal finance management. Take advantage of Excel’s features to design templates that align with your unique financial tracking requirements. Consider incorporating features such as conditional formatting to highlight key financial milestones or automated calculations to ease the manual workload.

Utilizing Excel Functions for Financial Analysis

Excel’s extensive library of functions allows for in-depth financial analysis. By utilizing functions like SUM, AVERAGE, and IF statements, you can gain insights into your financial patterns, assess your spending habits, and make informed financial decisions. Experiment with different functions to unleash the full potential of Excel in analyzing your personal finances.

As you embark on your journey to replace Mint.com with Excel for personal finance management, remember to embrace the freedom and flexibility that Excel offers. With its powerful features, customization options, and analytical capabilities, Excel can provide a tailored solution that caters to your unique financial needs. By following this comprehensive guide, you will be well-equipped to make the transition successfully and take full control over your personal finances.