Table of Contents

In today’s digital age, managing personal finances has become easier and more efficient. With the help of technology, we can now track our expenses, monitor our income, and analyze our financial data effortlessly. Google Sheets, a powerful and user-friendly spreadsheet program, can be a game-changer when it comes to personal finance management. In this article, we will explore how you can maximize your personal finance using Google Sheets, from understanding the importance of financial management to analyzing your financial data with ease.

Understanding Personal Finance Management

Before diving into the world of Google Sheets, it’s essential to understand the importance of personal finance management. When you have a clear understanding of your financial situation and goals, you can make informed decisions that will lead to financial stability and growth.

Personal finance management is not just about balancing your checkbook; it’s a comprehensive approach to handling your finances to secure a stable financial future. It involves understanding your spending habits, identifying areas where you can save or invest, and planning for unexpected expenses or financial goals.

The Importance of Personal Finance Management

Effective personal finance management allows you to budget properly, save for future goals, avoid debt, and make wise financial decisions. By organizing your financial data and tracking your income and expenses, you gain a comprehensive overview of your financial health, helping you make adjustments and improvements where necessary.

Moreover, personal finance management empowers you to take control of your financial destiny. It enables you to build an emergency fund, plan for retirement, and make strategic investments that align with your long-term financial objectives. By cultivating good financial habits and staying disciplined in your approach, you pave the way for a secure financial future.

Key Components of Personal Finance

Personal finance management combines various components to achieve financial success. These include budgeting, tracking income and expenses, setting financial goals, saving, investing, and analyzing financial data. By utilizing Google Sheets, you can tackle these components more effectively and streamline your personal finance management process.

Additionally, understanding the nuances of personal finance can also help you navigate complex financial situations such as tax planning, insurance coverage, and estate planning. It equips you with the knowledge and tools to make informed decisions that align with your financial aspirations and protect your financial well-being in the long run.

Introduction to Google Sheets

Google Sheets is a web-based spreadsheet program offered by Google. It provides a range of features and tools that help individuals and businesses manage their data effectively. Whether you’re a beginner or an experienced user, Google Sheets offers a user-friendly interface and robust functionality.

Google Sheets is not just limited to basic spreadsheet functions; it is a powerful tool that can handle complex data analysis and visualization tasks. With its cloud-based nature, Google Sheets allows for real-time collaboration, making it ideal for team projects and remote work. The ability to access your spreadsheets from any device with an internet connection adds to its convenience and flexibility.

Basic Features of Google Sheets

Google Sheets offers a variety of basic features that allow you to create, edit, and format your spreadsheet effortlessly. From adding data and formulas to applying formatting styles and sorting data, these basic features lay the foundation for efficient personal finance management.

Furthermore, Google Sheets seamlessly integrates with other Google Workspace applications such as Google Docs and Google Slides, enabling smooth data sharing and presentation creation. The autosave feature in Google Sheets ensures that your work is constantly saved, minimizing the risk of data loss due to unexpected interruptions.

Advanced Tools in Google Sheets

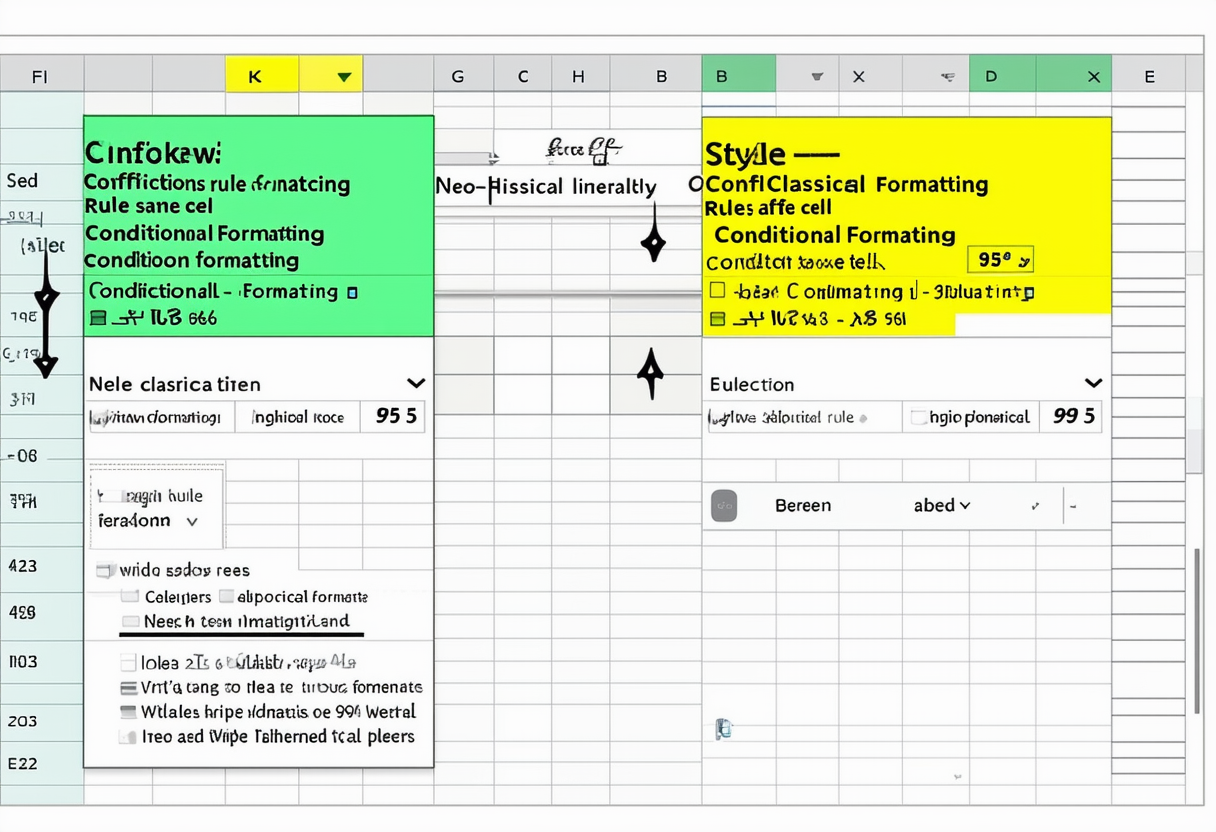

Apart from its basic features, Google Sheets provides advanced tools that enhance productivity and data analysis. These include conditional formatting, data validation, pivot tables, and macros. By leveraging these tools, you can save time, automate tasks, and gain deeper insights into your financial data.

Conditional formatting in Google Sheets allows you to visually highlight important data points based on specified criteria, making trends and outliers easily identifiable. Data validation helps maintain data integrity by setting rules for the type of data that can be entered into a cell. Pivot tables enable you to summarize and analyze large datasets with just a few clicks, providing a clear overview of your information. Additionally, macros in Google Sheets allow you to record and automate repetitive tasks, further streamlining your workflow.

Setting Up Your Personal Finance Spreadsheet

Once you’re familiar with Google Sheets’ features and tools, it’s time to set up your personal finance spreadsheet. Creating a well-organized and customized spreadsheet is crucial for effective personal finance management.

Creating Your First Spreadsheet

To get started, open Google Sheets and create a new spreadsheet. Give it a descriptive title, such as “Personal Finance Tracker.” Set up your columns, including categories such as income, expenses, date, and description. Take advantage of Google Sheets’ autofill feature to save time when entering recurring data.

Customizing Your Spreadsheet for Personal Finance

Customizing your spreadsheet is a personal preference, but adding visual elements and organizing your data can improve readability and ease of use. Utilize colors, fonts, and cell formatting to distinguish different types of data and highlight important information. Consider creating separate sheets for different financial aspects, such as budgeting, savings, and investments, to keep your data organized.

Tracking Your Income and Expenses

Recording and monitoring your income and expenses accurately is the foundation of personal finance management. Google Sheets provides the perfect platform for tracking your financial transactions effectively.

Recording Your Income in Google Sheets

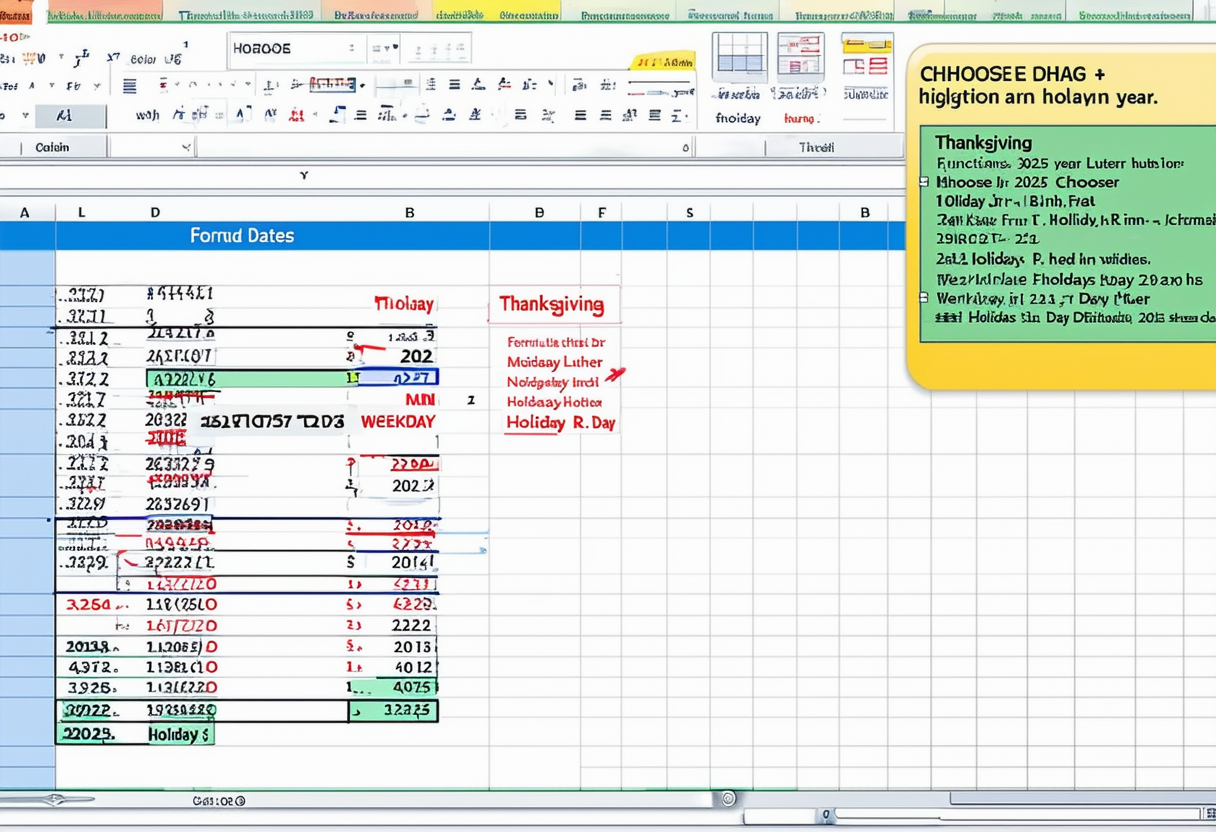

Create a dedicated section in your spreadsheet to record your income sources. Use separate rows for each income transaction, including the date, source, and amount. You can even use formulas to automatically calculate and update your total income. This enables you to keep track of your earnings and identify any changes or trends over time.

Logging Your Expenses Effectively

To gain control over your finances, it’s crucial to track your expenses diligently. Create a separate section in your spreadsheet to record each expense, including the date, category, description, and amount. You can categorize your expenses to gain insights into your spending patterns and identify areas where you can cut costs. Regularly tracking your expenses helps you stay within your budget and make informed financial decisions.

Analyzing Your Financial Data

By now, you’ve recorded your income and expenses in Google Sheets, but how do you make sense of all this data? Google Sheets offers powerful analysis tools that allow you to derive meaningful insights from your financial information.

Using Formulas for Financial Analysis

Google Sheets provides an extensive library of formulas that can help you analyze your financial data. Utilize formulas such as SUM, AVERAGE, and MAX to calculate total expenses, average income, and maximum spending, respectively. By applying these formulas, you can quickly assess your financial health and make data-driven decisions.

Visualizing Your Financial Data with Charts

Data visualization is a powerful tool for understanding financial data at a glance. Google Sheets offers a range of chart types, including pie charts, bar graphs, and line charts, to help you visualize your financial information. Use charts to identify trends, compare income and expenses, and visualize your progress towards financial goals. These visual representations make it easier to comprehend complex data and communicate your financial situation clearly.

In conclusion, personal finance management plays a crucial role in building a strong financial foundation. By utilizing Google Sheets, you can streamline your financial management process, track your income and expenses effectively, and analyze your financial data with ease. Get started with Google Sheets today and take control of your personal finances like never before!