Table of Contents

In today’s fast-paced and ever-changing world, personal finance has become a vital skill for everyone to master. With the help of spreadsheets, managing your finances has never been easier. In this article, we will explore the basics of personal finance and how spreadsheets can be a valuable tool in organizing and planning your financial future. Whether you’re new to personal finance or looking to take your skills to the next level, this guide will provide you with the knowledge and tools to become a financial whiz.

Understanding the Basics of Personal Finance

Before diving into the world of spreadsheets, it’s important to have a solid understanding of the basic concepts of personal finance. Financial literacy is the foundation upon which all our financial decisions are based. Having a good grasp of financial concepts like budgeting, saving, investing, and managing debt is crucial for achieving financial success.

Personal finance is not just about managing money; it’s about making informed decisions that can impact your financial well-being in the long run. By understanding the basics of personal finance, individuals can create a roadmap for their financial future and work towards their goals with confidence.

Importance of Financial Literacy

Financial literacy is the knowledge and understanding of various financial concepts that allows individuals to make informed and effective decisions regarding their money. It helps individuals navigate the complex world of personal finance and make choices that align with their financial goals. Being financially literate empowers individuals to take control of their finances and make smart decisions that can positively impact their future.

Financial literacy is a lifelong learning process that evolves as individuals’ financial situations change. It equips individuals with the skills to manage unexpected financial challenges and seize opportunities for growth and wealth accumulation.

Key Concepts in Personal Finance

When it comes to personal finance, there are several key concepts that everyone should be familiar with. These include budgeting, saving, investing, managing debt, and understanding your credit score. These concepts lay the foundation for financial success and are essential for achieving financial stability and independence.

Budgeting is the cornerstone of personal finance, as it helps individuals track their income and expenses, identify areas for saving, and plan for future financial goals. Saving is not just about setting money aside; it’s about cultivating a mindset of financial discipline and preparing for emergencies or future investments. Investing allows individuals to grow their wealth over time by putting their money to work in various financial instruments. Managing debt is crucial for maintaining a healthy financial profile and avoiding unnecessary financial stress. Understanding your credit score is essential for accessing credit at favorable terms and monitoring your financial health.

Introduction to Spreadsheets

Now that we have a good understanding of the basics of personal finance, let’s explore the world of spreadsheets. Spreadsheets are powerful tools that allow you to organize, analyze, and manipulate data. They can be used for a wide range of tasks, including personal finance management.

Basics of Spreadsheet Software

Spreadsheet software, such as Microsoft Excel or Google Sheets, provides a user-friendly interface for creating and manipulating spreadsheets. They offer a wide range of functionalities, including formulas, functions, and formatting options, which make them ideal for managing personal finances. Learning the basics of spreadsheet software is essential for effectively using spreadsheets for personal finance.

Advantages of Using Spreadsheets for Finance

Spreadsheets offer several advantages when it comes to managing personal finances. Firstly, they provide a centralized location for all your financial data, making it easy to track and manage your income, expenses, and savings. Secondly, spreadsheets allow for easy customization, allowing you to tailor your financial tracking to your specific needs. Lastly, spreadsheets offer powerful analytical tools, such as formulas and functions, that enable you to gain valuable insights into your financial situation.

Organizing Your Personal Finances

Now that we have a solid foundation in both personal finance and spreadsheet basics, let’s dive into organizing your personal finances using spreadsheets. This section will focus on creating a personal budget spreadsheet and tracking your income and expenses effectively.

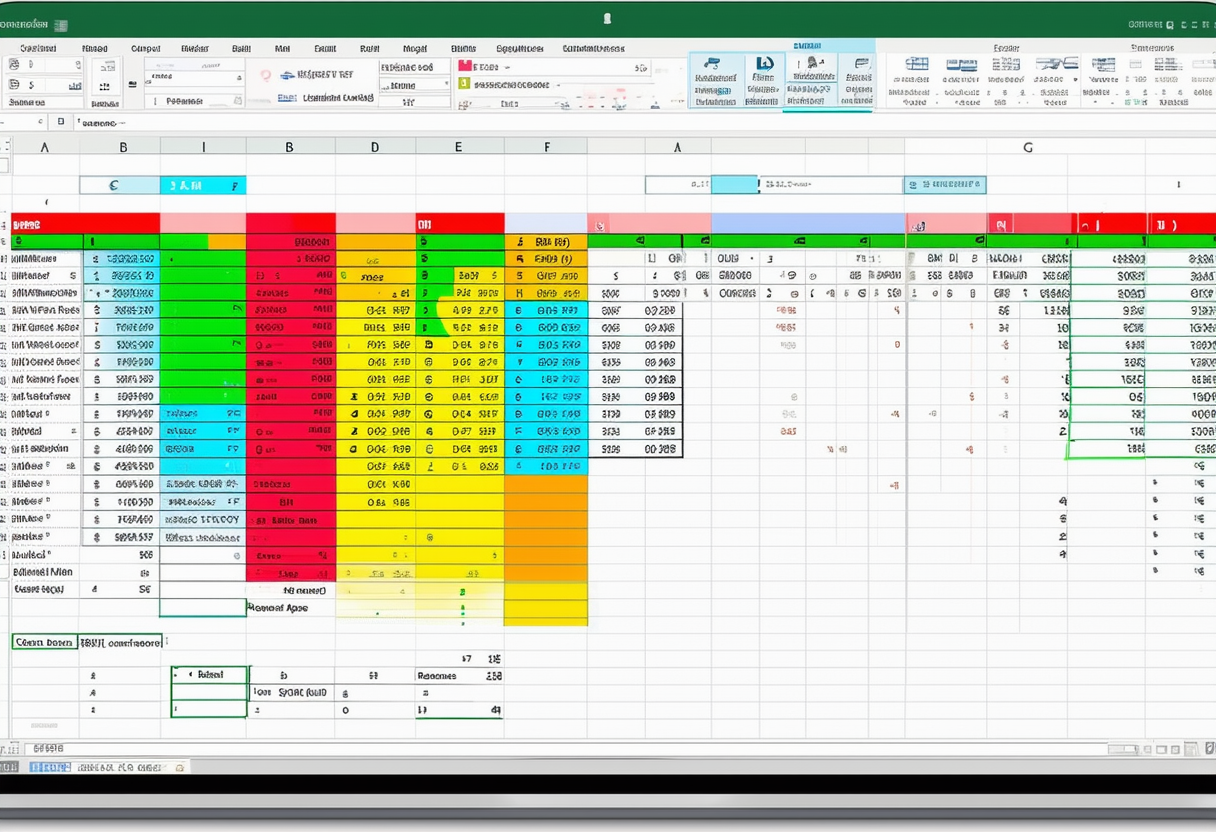

Creating a Personal Budget Spreadsheet

A personal budget spreadsheet is an essential tool for managing your finances. It allows you to allocate your income to different expense categories and track your spending to ensure that you’re living within your means. By creating a budget spreadsheet, you can gain a clear understanding of your cash flow and identify areas where you can save or cut back on expenses.

Tracking Income and Expenses

Tracking your income and expenses is crucial for maintaining a healthy financial life. A dedicated spreadsheet can help you keep a record of your earnings and expenditures, making it easier to understand where your money is going. By regularly updating and reviewing your income and expenses spreadsheet, you can better manage your finances and make informed decisions about saving and spending.

Planning for the Future with Spreadsheets

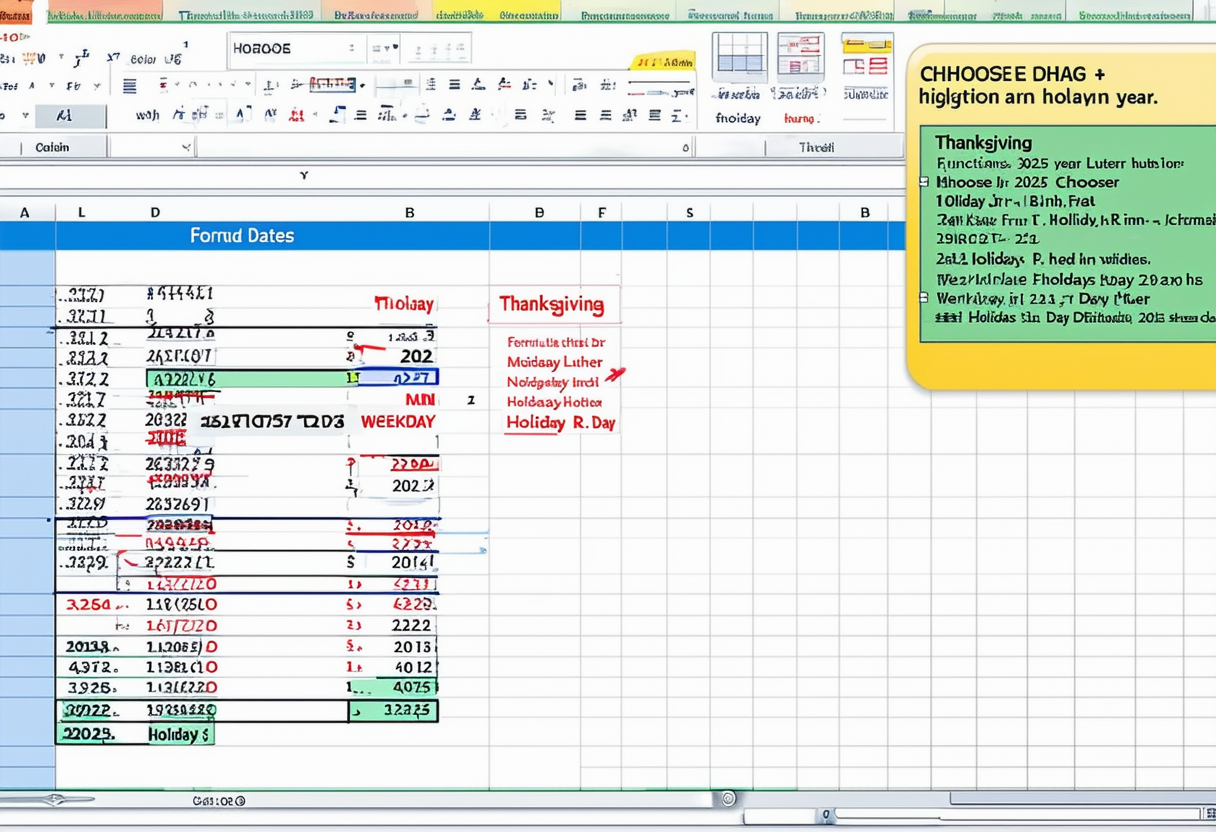

Once you have a firm grip on managing your day-to-day finances, it’s time to start thinking about your financial future. This section will explore debt reduction strategies and saving and investment planning, using spreadsheets to set you on the path to a secure financial future.

Debt Reduction Strategies

If you have outstanding debts, developing a plan to pay them off is essential for achieving financial freedom. With the help of spreadsheets, you can create a debt repayment plan that allows you to track your progress and stay motivated. By utilizing debt reduction strategies such as the snowball or avalanche method, you can systematically tackle your debts and ultimately become debt-free.

Saving and Investment Planning

Building a savings and investment plan is crucial for achieving long-term financial goals such as buying a house, starting a business, or retiring comfortably. Spreadsheets can be a valuable tool for setting savings goals, tracking investment performance, and monitoring your progress over time. By regularly updating and reviewing your savings and investment spreadsheet, you can stay on track and make adjustments as needed to achieve your financial aspirations.

Advanced Spreadsheet Techniques for Personal Finance

As you become more comfortable with spreadsheets, you can start exploring advanced techniques for personal finance management. This section will introduce you to using formulas and functions for financial calculations and data visualization for financial analysis.

Using Formulas and Functions for Financial Calculations

Spreadsheets offer a wide range of formulas and functions that can simplify complex financial calculations. Whether you’re calculating compound interest, analyzing investment returns, or creating advanced budgeting models, formulas and functions can help you automate your calculations and save time. Understanding how to leverage these tools can take your personal finance management to the next level.

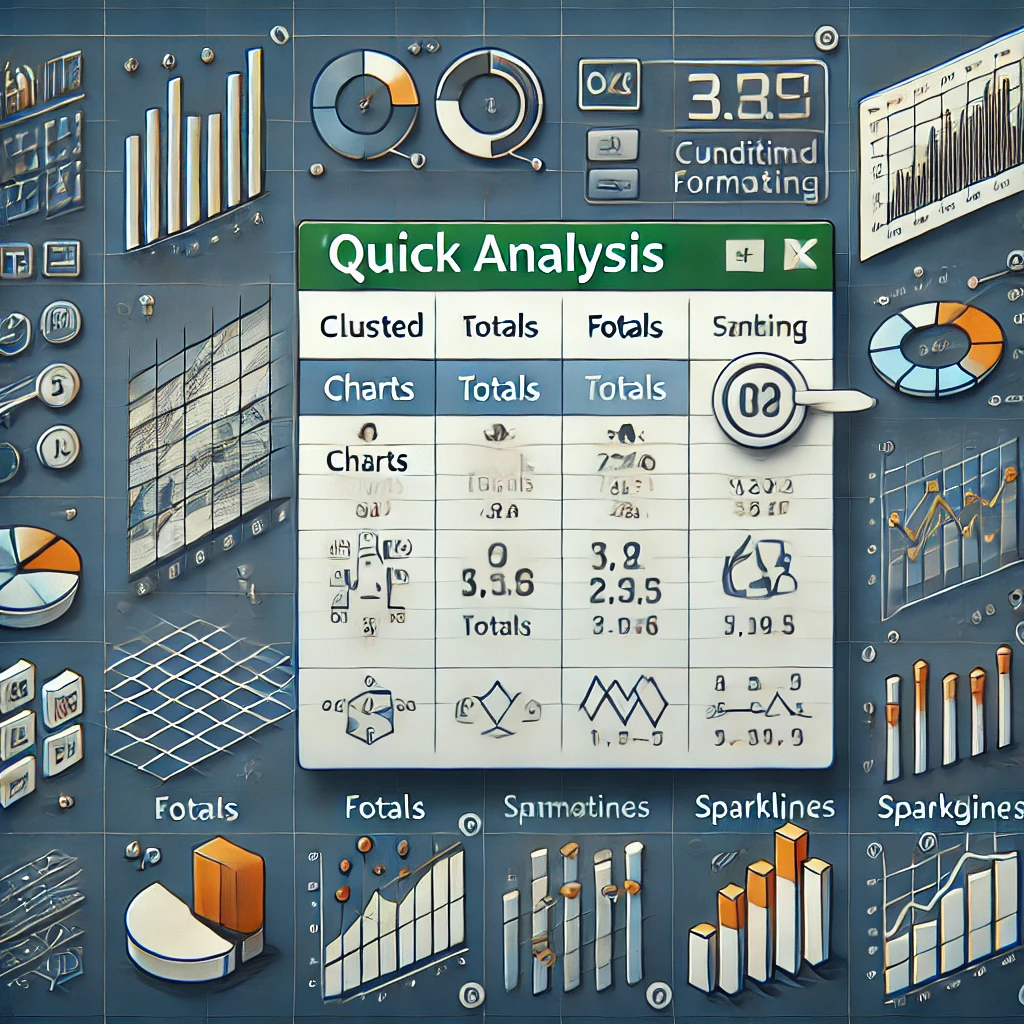

Data Visualization for Financial Analysis

Data visualization is a powerful technique for analyzing and presenting financial data in a visually appealing way. By using graphs, charts, and other visual elements, you can gain a better understanding of your financial situation and identify trends or patterns that may not be immediately apparent in raw data. Data visualization can be particularly useful when presenting your financial information to others, such as stakeholders or financial advisors.

Now that you have a comprehensive understanding of personal finance and how spreadsheets can be used to master your financial journey, it’s time to put your newfound knowledge into practice. Start by creating a personal finance spreadsheet, setting financial goals, and regularly tracking your progress. Remember, mastering personal finance is a lifelong learning process, and spreadsheets can be your trusted companion along the way.