Table of Contents

Personal finance plays a crucial role in our lives, and managing it effectively is essential for a secure future. In today’s digital age, Excel has become an invaluable tool for financial management. This comprehensive guide will take you on a journey to master personal finance using Excel, providing you with the knowledge and skills to navigate the complexities of budgeting, debt management, and retirement planning.

Understanding the Basics of Personal Finance

Before diving into the world of Excel, it is important to grasp the fundamentals of personal finance. Effective management of your finances enables you to achieve your financial goals while maintaining a balanced financial life.

Personal finance is not just about budgeting and saving; it encompasses a wide range of financial activities that impact your daily life. From understanding credit scores to navigating the complex world of taxes, personal finance plays a crucial role in shaping your financial well-being.

Importance of Personal Finance Management

Personal finance management empowers you to make informed decisions about your income, expenses, and investments. By understanding your financial situation, you can create a solid foundation for a prosperous future.

Moreover, mastering personal finance management can provide you with a sense of financial security and peace of mind. Knowing that you have a clear financial plan in place can alleviate stress and help you navigate unexpected financial challenges with confidence.

Key Components of Personal Finance

To successfully manage your personal finances, you need to focus on several core components. These include budgeting, saving, investing, debt management, and retirement planning. By mastering these areas, you can establish a strong financial framework.

Each component of personal finance plays a vital role in shaping your financial future. Budgeting helps you track your expenses and prioritize your spending, while saving and investing ensure that you have financial stability and growth over time. Debt management allows you to effectively handle any outstanding debts, while retirement planning sets the stage for a comfortable and secure future.

Introduction to Excel for Personal Finance

Excel provides a powerful platform for personal finance management. Its flexibility, ease of use, and advanced functionality make it an ideal tool for creating budgets, analyzing data, and tracking financial progress.

When it comes to managing personal finances, Excel stands out as a versatile and reliable tool. Whether you are a seasoned finance professional or just starting to take control of your money, Excel’s capabilities can help you stay organized and informed about your financial situation. From creating detailed budgets to visualizing spending patterns, Excel offers a wide range of features to support your financial goals.

Why Use Excel for Personal Finance?

Excel offers numerous advantages for personal finance management. Its spreadsheet format allows for easy organization and manipulation of financial data, while its built-in formulas and functions streamline complex calculations.

Moreover, Excel’s customizable templates provide a convenient starting point for various financial tasks, such as expense tracking, investment portfolio management, and retirement planning. By harnessing the power of Excel, individuals can gain a deeper understanding of their financial health and make informed decisions to achieve their monetary objectives.

Basic Excel Functions for Financial Management

Before you delve into utilizing Excel for personal finance, it is essential to brush up on some basic functions. Excel’s SUM, AVERAGE, and MAX functions, among others, are valuable tools for analyzing and summarizing financial data.

Additionally, Excel’s data visualization tools, such as charts and graphs, can help you identify trends, outliers, and opportunities within your financial data. By mastering these fundamental functions and features, you can leverage Excel to enhance your financial management skills and drive better financial outcomes.

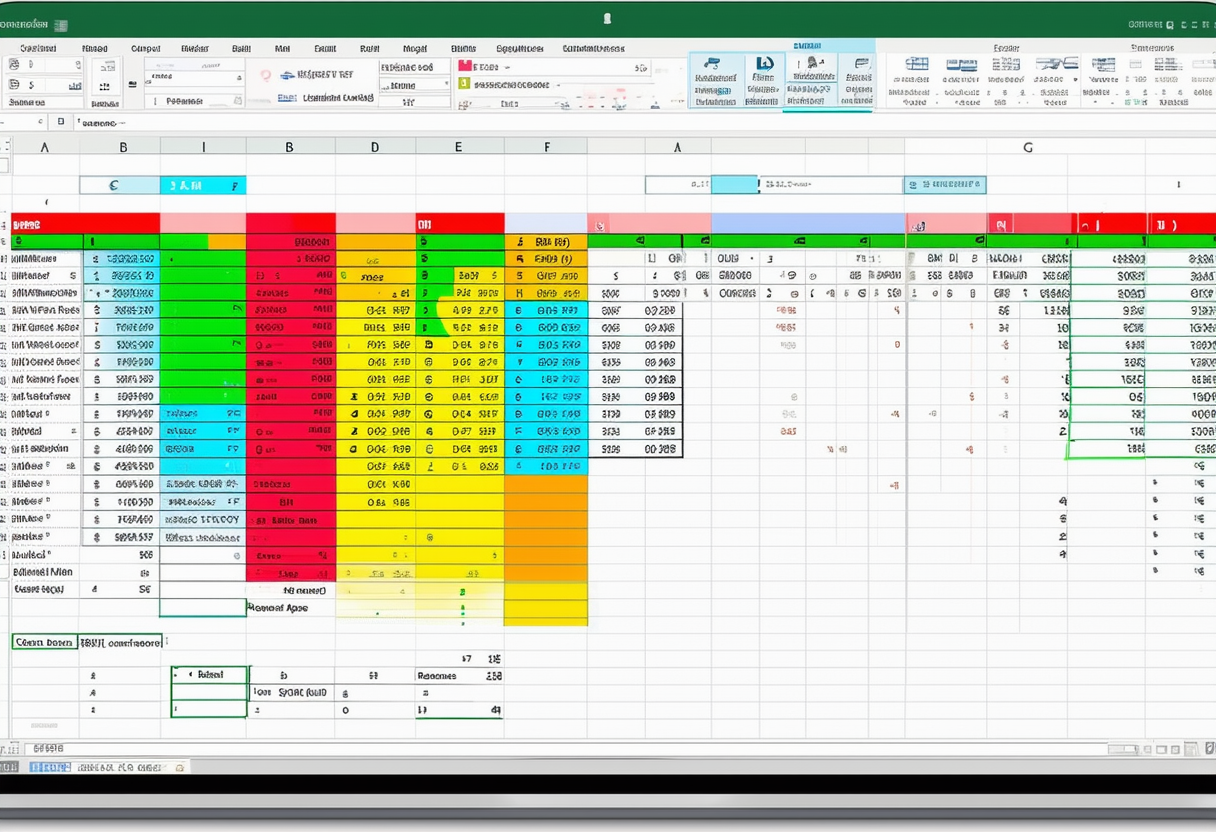

Creating a Personal Budget in Excel

A personal budget serves as the foundation for solid financial management. Excel enables you to create a comprehensive budgeting template that allows you to track your income and expenses, providing a clear picture of your financial health.

Developing a personal budget not only helps you manage your finances efficiently but also empowers you to make informed decisions about your money. By utilizing Excel’s features, you can gain insights into your financial habits and work towards achieving your financial goals with confidence.

Setting Up Your Budget Template

The first step in creating a personal budget is setting up a template within Excel. You can customize your template to match your specific income sources, expense categories, and financial goals. By organizing these aspects systematically, you can maintain better control over your finances.

When designing your budget template, consider incorporating additional sections for savings goals, debt repayment plans, and emergency funds. These elements can provide a more holistic view of your financial situation and help you prioritize your financial objectives effectively.

Tracking Income and Expenses

Once your budget template is in place, Excel assists you in tracking your income and expenses effectively. By regularly inputting your financial transactions, you can easily monitor your spending patterns, identify areas for improvement, and make necessary adjustments to achieve your financial objectives.

Furthermore, Excel’s functions allow you to create visual representations of your budget data, such as graphs and charts, making it easier to analyze trends and patterns in your financial behavior. This visual aid can enhance your budgeting experience and provide a more intuitive understanding of your financial standing.

Managing Debt with Excel

Debt can often feel overwhelming, but with Excel, you can take control of your debts and develop effective repayment strategies.

When it comes to managing debt, having a clear understanding of your financial situation is crucial. Excel provides a comprehensive platform where you can input all your debts, including outstanding balances, interest rates, and minimum monthly payments. By organizing this information in one central location, you can have a holistic view of your debt landscape, making it easier to formulate a repayment plan.

Calculating Interest and Payments

Excel’s built-in financial functions, such as PMT and IPMT, enable you to calculate interest and payments associated with your debts. This data allows you to understand the impact of interest rates on your repayments and develop strategies to pay off your debts efficiently.

Moreover, Excel’s ability to create visual representations of your debt structure through charts and graphs can provide valuable insights. By visualizing how much of your payments go towards interest versus the principal amount, you can identify opportunities to optimize your repayment strategy and potentially save money in the long run.

Debt Reduction Strategies in Excel

With Excel’s organizational capabilities, you can create a debt reduction plan that suits your financial situation. By using tools like the debt snowball or debt avalanche method, you can prioritize and allocate your resources effectively, accelerating your journey towards debt-free living.

Additionally, Excel allows you to scenario plan and simulate various repayment scenarios. By adjusting variables such as monthly payment amounts or interest rates, you can assess the impact on your debt-free timeline. This flexibility empowers you to make informed decisions and adapt your strategy as needed, ensuring steady progress towards financial freedom.

Planning for Retirement Using Excel

Retirement planning is a critical aspect of personal finance, and Excel can be instrumental in estimating your retirement savings and creating a detailed retirement plan.

Estimating Retirement Savings

Excel’s power lies in its ability to perform complex calculations with ease. By using functions such as FV and PMT, you can estimate your retirement savings based on factors like current investments, expected growth rates, and retirement age. This insight empowers you to take the necessary steps to secure a comfortable retirement.

Creating a Retirement Plan

With Excel, you can devise a comprehensive retirement plan that encompasses your financial needs and goals. By considering factors such as projected expenses, income sources, and investment options, you can make informed decisions that ensure a financially secure retirement.

Mastering personal finance with Excel equips you with the tools and knowledge to take control of your financial future. By understanding the basics of personal finance, leveraging Excel’s capabilities, and implementing effective strategies, you can achieve financial stability and pave the way for a prosperous tomorrow.