Table of Contents

Creating and sticking to a personal budget is a crucial step towards financial stability and achieving your financial goals. With the advent of technology, there are various tools available to help you manage your budget effectively. One such tool is Excel, a powerful spreadsheet program that can assist you in creating and maintaining your personal budget. In this article, we will walk you through the process of creating personal budgets using Excel, starting from understanding the basics of personal budgeting to analyzing your budget for better financial decision making.

Understanding the Basics of Personal Budgeting

Before diving into Excel, it is important to have a clear understanding of personal budgeting and its significance. Personal budgeting involves tracking and managing your income and expenses to ensure that you are living within your means. It helps you allocate your resources effectively, prioritize your spending, and save for future goals. By creating a budget, you gain control over your finances and avoid unnecessary debt or financial hardships.

Personal budgeting is a fundamental aspect of financial literacy that empowers individuals to take charge of their money management. It serves as a financial GPS, guiding you towards your desired financial destination. By practicing effective budgeting, you cultivate healthy financial habits that can lead to long-term financial stability and success.

The Importance of Personal Budgeting

Personal budgeting is essential because it allows you to have a clear view of your financial situation. It helps you identify areas where you may be overspending and make adjustments accordingly. Budgeting also enables you to set financial goals, such as saving for a down payment on a house or paying off debt, and provides a roadmap for achieving them.

Moreover, personal budgeting promotes mindfulness and awareness of your spending patterns. It encourages you to think critically about your financial decisions and consider the long-term implications of your choices. By embracing a budgeting mindset, you develop a proactive approach to managing your finances and gain a deeper understanding of the value of each dollar you earn.

Key Components of a Personal Budget

When creating a personal budget, there are several key components that you need to consider. These include your income, expenses, savings goals, and any debts or obligations you have. It is important to capture all sources of income and categorize your expenses to get a comprehensive view of your financial situation. This will enable you to make informed decisions and allocate your resources effectively.

Furthermore, a well-structured personal budget incorporates a buffer for unexpected expenses or emergencies. By including a contingency fund in your budget, you can safeguard yourself against financial shocks and maintain financial resilience. This proactive approach to budgeting ensures that you are prepared for unforeseen circumstances and can navigate financial challenges with confidence.

Getting Started with Excel

Now that you have a basic understanding of personal budgeting, it’s time to familiarize yourself with Excel and its features that can assist you in creating and managing your budget efficiently.

Excel is a powerful tool that offers a wide range of functionalities beyond basic budgeting. From creating dynamic charts to analyzing complex data sets, Excel can be used for various tasks in both personal and professional settings. Understanding the full potential of Excel can greatly enhance your productivity and decision-making capabilities.

Familiarizing Yourself with Excel

If you are new to Excel, it is helpful to spend some time getting to know the program and its functionalities. Excel is a spreadsheet program that allows you to organize and analyze data. You can create tables, use formulas and functions, and customize the appearance of your spreadsheets. Take some time to explore the different options and menus in Excel to gain familiarity with the program.

One of the key features of Excel is its ability to handle large datasets efficiently. Whether you are tracking expenses for a month or analyzing sales data for a year, Excel’s capacity to handle vast amounts of information makes it a valuable tool for budgeting and financial analysis. By learning how to effectively manage and manipulate data in Excel, you can streamline your budgeting process and gain valuable insights into your financial situation.

Essential Excel Functions for Budgeting

To create a personal budget in Excel, it is important to understand and utilize some essential functions. These functions will make your budgeting process more efficient and accurate. Key functions include SUM, AVERAGE, IF, and VLOOKUP. The SUM function allows you to add up numbers, while the AVERAGE function calculates the average of a range of values. The IF function helps you make decisions based on certain conditions, and the VLOOKUP function allows you to retrieve data from different parts of your spreadsheet.

In addition to these basic functions, Excel offers a wide range of advanced functions that can further enhance your budgeting capabilities. Functions like PMT for calculating loan payments, NPV for evaluating investments, and HLOOKUP for horizontal lookup can provide valuable insights into your financial data. By exploring and mastering these functions, you can take your budgeting skills to the next level and make more informed financial decisions.

Setting Up Your Personal Budget in Excel

Now that you have a good grasp of the basics, it’s time to create your personal budget template in Excel.

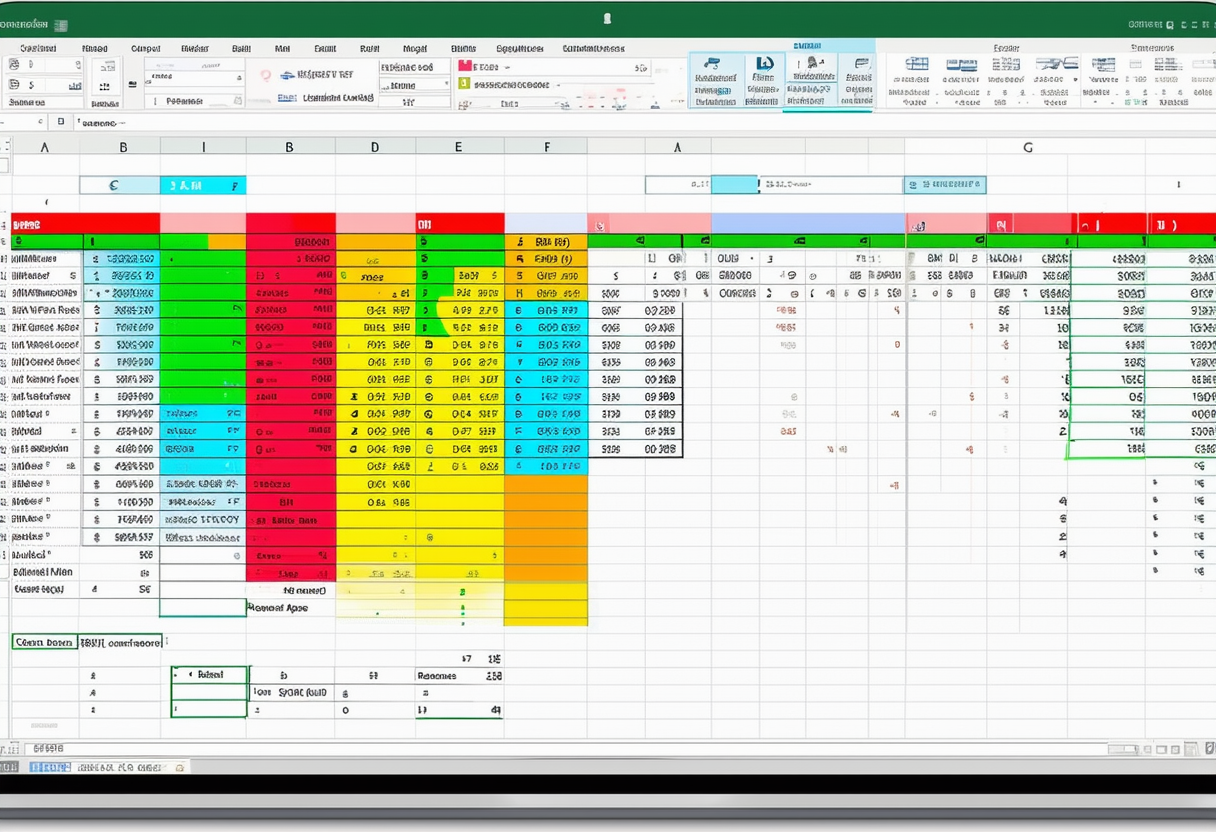

Creating Your Budget Template

The first step in setting up your personal budget in Excel is to create a budget template. This template will serve as the foundation for your budgeting process. Start by opening a new Excel spreadsheet and creating column headers for different categories such as income, expenses, savings, and debts. You can customize the template according to your specific needs and preferences.

Inputting Your Income and Expenses

Once you have your budget template ready, it’s time to input your income and expenses. Begin by listing all sources of income, such as salary, bonuses, or side hustles, in the income column. Next, categorize your expenses and list them in the respective expense categories. Remember to be thorough and include all regular and recurring expenses, such as rent, utilities, groceries, transportation, and any other bills or subscriptions.

Customizing Your Excel Budget

Now that you have set up your personal budget in Excel, you can customize it further to suit your individual needs and preferences.

Adding Categories to Your Budget

If you find that your budget template does not include all the categories you need, you can easily add or modify categories in Excel. Simply insert new rows or columns and label them accordingly. For example, if you want to track a specific type of expense, like entertainment or travel, you can create a new expense category and input the relevant expenses.

Adjusting Your Budget Over Time

As your financial situation and goals evolve, you may need to make adjustments to your budget. Excel makes it easy to modify your budget by simply updating the numbers in the respective columns. For example, if you receive a pay raise or decide to cut back on certain expenses, you can update the income and expense categories accordingly.

Analyzing Your Budget in Excel

Once you have been using your personal budget in Excel for a while, it is important to regularly analyze and review your budget to track your progress and make informed financial decisions.

Using Excel to Track Spending Habits

Excel provides various tools that allow you to track and analyze your spending habits. You can use charts and graphs to visually represent your income and expenses, making it easier to identify patterns and trends. Additionally, Excel’s filtering and sorting capabilities enable you to analyze your budget from different perspectives, such as by category or timeframe.

Identifying Areas for Improvement

By regularly reviewing your budget in Excel, you can identify areas for improvement and make necessary adjustments. For example, if you notice that you are consistently overspending in a particular expense category, you can take proactive steps to reduce those expenses. Similarly, if you have been successfully saving towards a specific goal, you can celebrate your progress and continue working towards achieving it.

In conclusion, creating personal budgets with Excel is an effective way to manage your finances and achieve your financial goals. By understanding the basics of personal budgeting, familiarizing yourself with Excel, setting up your budget template, customizing it according to your needs, and analyzing your budget regularly, you can gain control over your finances and make informed financial decisions. So, get started today and take charge of your financial future!