Table of Contents

Budgeting is an essential tool for managing your family’s finances effectively. By carefully planning and tracking your income and expenses, you can ensure that you are spending your money wisely and saving for your future goals. One powerful tool that can assist you in this process is Microsoft Excel. In this comprehensive guide, we will explore the basics of budgeting, how Excel can help you create a budget, and how to customize and track your spending using this versatile software.

Understanding the Basics of Budgeting

Before diving into the world of budgeting with Excel, let’s start by understanding the foundations of budgeting itself. Budgeting refers to the process of allocating your income towards various expenses and financial goals. It helps you to prioritize your spending, eliminate wasteful expenses, and ensure that you have enough money to cover your essential needs while still saving for the future.

When creating a budget, it’s important to consider both fixed and variable expenses. Fixed expenses are recurring costs that remain constant each month, such as rent or mortgage payments, while variable expenses fluctuate, like groceries or entertainment. By categorizing your expenses in this way, you can better plan for both the predictable and unpredictable aspects of your financial life.

What is Budgeting?

At its core, budgeting involves setting financial goals, tracking income, and categorizing expenses. By creating a budget, you gain a clear understanding of where your money is going and can make informed decisions about how to allocate your resources.

Another key aspect of budgeting is establishing a savings plan. Setting aside a portion of your income for savings each month is essential for building an emergency fund, investing for the future, and achieving financial security. By prioritizing savings in your budget, you can work towards your long-term financial objectives with confidence.

Why is Budgeting Important?

Budgeting plays a crucial role in achieving financial stability and success. It enables you to save for emergencies, plan for retirement, pay off debt, and achieve your long-term goals. Without a budget, it can be challenging to keep track of your spending, and you may find yourself overspending or struggling to make ends meet.

Moreover, budgeting can help you identify areas where you can cut back on expenses and reallocate those funds towards your priorities. Whether it’s dining out less frequently, finding more affordable housing options, or reducing unnecessary subscriptions, budgeting empowers you to make conscious choices about your money and align your spending with your values.

The Role of Excel in Budgeting

Excel is an incredibly powerful tool that can simplify the budgeting process and provide you with valuable insights into your financial situation. With its user-friendly interface and robust calculation capabilities, Excel allows you to create and customize budgets to suit your specific needs.

Furthermore, Excel offers the flexibility to create visual representations of your budget data, such as charts and graphs, which can enhance your understanding of your financial patterns and trends. By leveraging Excel’s features, you can gain a comprehensive view of your finances, track your progress towards your goals, and make informed decisions to optimize your financial health.

Setting Up Your Family Budget in Excel

Now that we have a solid understanding of budgeting, let’s dive into setting up your family budget in Excel. Managing your finances effectively is crucial for achieving your financial goals and securing your future.

When it comes to setting up a family budget in Excel, the key is to be organized and thorough. By following a structured approach, you can gain valuable insights into your spending habits and make informed decisions about your financial priorities.

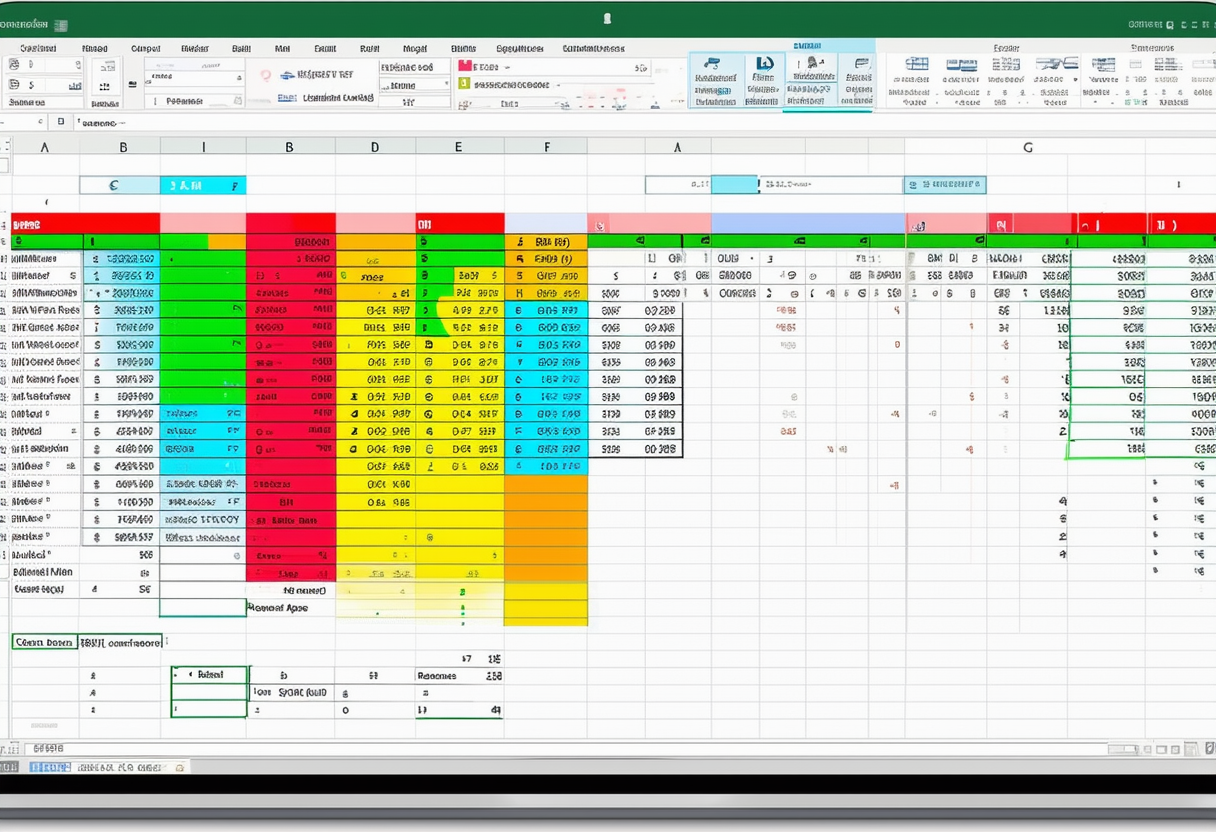

Creating Your Budget Template

The first step in creating your budget is to set up a template that will serve as the foundation for your financial planning. Start by opening Excel and creating a new workbook. Consider using a separate worksheet for each month or year to allow for easy tracking and comparison. This level of detail will enable you to monitor your financial progress over time and make adjustments as needed.

Furthermore, customizing your budget template to suit your specific needs is essential. You may want to include additional sections for savings goals, debt repayment, or irregular expenses to ensure that all aspects of your financial life are accounted for.

Inputting Your Income and Expenses

Once you have your budget template ready, it’s time to input your income and expenses. Begin by listing all sources of income, such as salaries, investments, and rental income. Then, categorize your expenses into different groups, such as housing, transportation, groceries, and entertainment. Be as detailed as possible to gain a comprehensive overview of your financial situation. Remember to include both fixed expenses, like rent or mortgage payments, and variable expenses, such as dining out or shopping.

Tracking your income and expenses accurately is crucial for understanding your cash flow and identifying areas where you can potentially cut costs or increase savings. By maintaining detailed records, you can make informed decisions about your spending habits and work towards achieving your financial objectives.

Adding Formulas for Automatic Calculations

One of Excel’s greatest strengths lies in its ability to perform complex calculations and automate repetitive tasks. Take advantage of this feature by adding formulas to your budget template. For example, you can use the SUM function to calculate total income and expenses, and the IF function to create conditional statements based on specific criteria. By leveraging Excel’s formula capabilities, you can streamline your budgeting process and gain valuable insights into your financial health.

Moreover, incorporating visual representations, such as charts or graphs, can enhance the clarity of your budget data and make it easier to identify trends or patterns. Visualizing your financial information can help you make more informed decisions and stay on track with your budgeting goals.

Customizing Your Excel Budget

Now that you have set up the basics of your Excel budget, it’s time to customize it to fit your specific needs and preferences.

Adjusting Your Budget to Fit Your Needs

Your budget should reflect your unique financial situation and goals. Take the time to review your income and expenses regularly and make adjustments as needed. For example, you may need to reallocate funds towards a particular area or adjust your savings goals based on changing circumstances.

Using Excel Features to Enhance Your Budget

Excel offers various features that can enhance your budgeting experience. For instance, you can use conditional formatting to highlight specific cells based on predefined criteria, making it easier to identify areas that need attention. Additionally, Excel’s charting capabilities allow you to visualize your spending patterns and track your progress towards your financial goals.

Protecting Your Budget with Passwords and Permissions

Given the sensitive nature of financial information, it is crucial to protect your budget from unauthorized access. Excel provides options for password-protecting your worksheets and restricting access to specific users. This safeguard ensures that only authorized individuals can make changes to your budget.

Tracking Your Spending in Excel

In addition to creating and customizing your budget, Excel can also help you track your daily expenses and gain valuable insights into your spending habits.

Recording Your Daily Expenses

Creating a habit of recording your daily expenses in Excel can provide you with a comprehensive overview of where your money goes. Consider setting up a simple table where you can enter expenses as they occur. This not only helps you stay accountable but also makes it easier to analyze your spending patterns and identify areas where you can cut back.

Analyzing Your Spending Patterns

Regularly reviewing and analyzing your spending patterns allows you to make informed decisions and take control of your finances. Excel offers various tools, such as pivot tables and filters, that can help you analyze your spending by category, time period, or any other relevant criteria. Use these features to identify trends, set realistic goals, and make adjustments as needed.

Making Adjustments Based on Your Spending

Based on your spending analysis, you may discover areas where you can make adjustments to save more money or reduce unnecessary expenses. Adjust your budget accordingly, reallocating funds towards your financial goals or cutting back on non-essential items. By monitoring and adjusting your budget over time, you can ensure that it remains effective and aligned with your priorities.

In conclusion, Excel is an invaluable tool for family budget planning. By understanding the fundamentals of budgeting, setting up your budget in Excel, customizing it to fit your needs, and tracking your spending, you can gain better control over your finances and work towards achieving your financial goals. Start by implementing the tips and techniques outlined in this comprehensive guide, and enjoy the benefits of a well-planned and effectively managed family budget.