Table of Contents

In today’s digital age, mastering Excel is a crucial skill for anyone looking to take control of their personal finances. This powerful spreadsheet program offers a multitude of functions and formulas that can help you analyze data, create budgets, track expenses, and plan for long-term financial goals. Whether you’re a budget-conscious individual or a seasoned investor, understanding and utilizing Excel can greatly enhance your ability to make informed financial decisions. In this article, we will explore some essential Excel formulas that you can master to take your personal finance management to the next level.

Understanding the Basics of Excel for Personal Finance

Before diving into the world of Excel formulas, it’s important to have a solid understanding of the basics. Excel is organized into columns and rows, forming individual cells where you can input different types of data. These cells can then be used to perform calculations, create equations, and generate valuable insights.

When working with Excel for personal finance, it’s crucial to establish a clear structure for your financial data. By organizing your income, expenses, savings, and investments into separate sections within the spreadsheet, you can easily track and analyze each aspect of your financial health. This structured approach not only helps in maintaining accuracy but also provides a comprehensive overview of your financial situation.

Importance of Excel in Personal Finance

Excel is a versatile tool that can be customized to fit your unique personal finance needs. Its ability to handle complex calculations, analyze large data sets, and create dynamic charts makes it an invaluable asset for anyone looking to gain clarity and control over their financial situation. With Excel, you can track your income and expenses, create detailed budgets, and monitor the performance of your investments.

Moreover, Excel offers a wide range of financial functions and formulas that can automate repetitive tasks and streamline your financial analysis. Functions like PMT for calculating loan payments, PV for determining present value, and IRR for evaluating investment returns can significantly enhance your financial decision-making process. By leveraging these advanced features, you can make informed choices that align with your long-term financial goals.

Essential Excel Skills for Financial Management

While Excel may seem intimidating at first, mastering a few key skills can go a long way in simplifying your financial management tasks. Knowing how to input data accurately, format cells, and use basic formulas such as SUM, AVERAGE, and COUNT can help you streamline your budgeting process and gain valuable insights into your spending habits.

Furthermore, learning more advanced functions like VLOOKUP for searching and retrieving specific data, IF statements for conditional calculations, and PivotTables for dynamic data analysis can take your financial modeling capabilities to the next level. These skills not only save time but also enable you to perform in-depth financial analysis with ease, empowering you to make well-informed financial decisions.

Excel Formulas for Budgeting

Creating and sticking to a budget is an essential part of personal finance management. Excel offers a range of formulas that can assist you in tracking your income, expenses, and savings goals.

Creating a Personal Budget in Excel

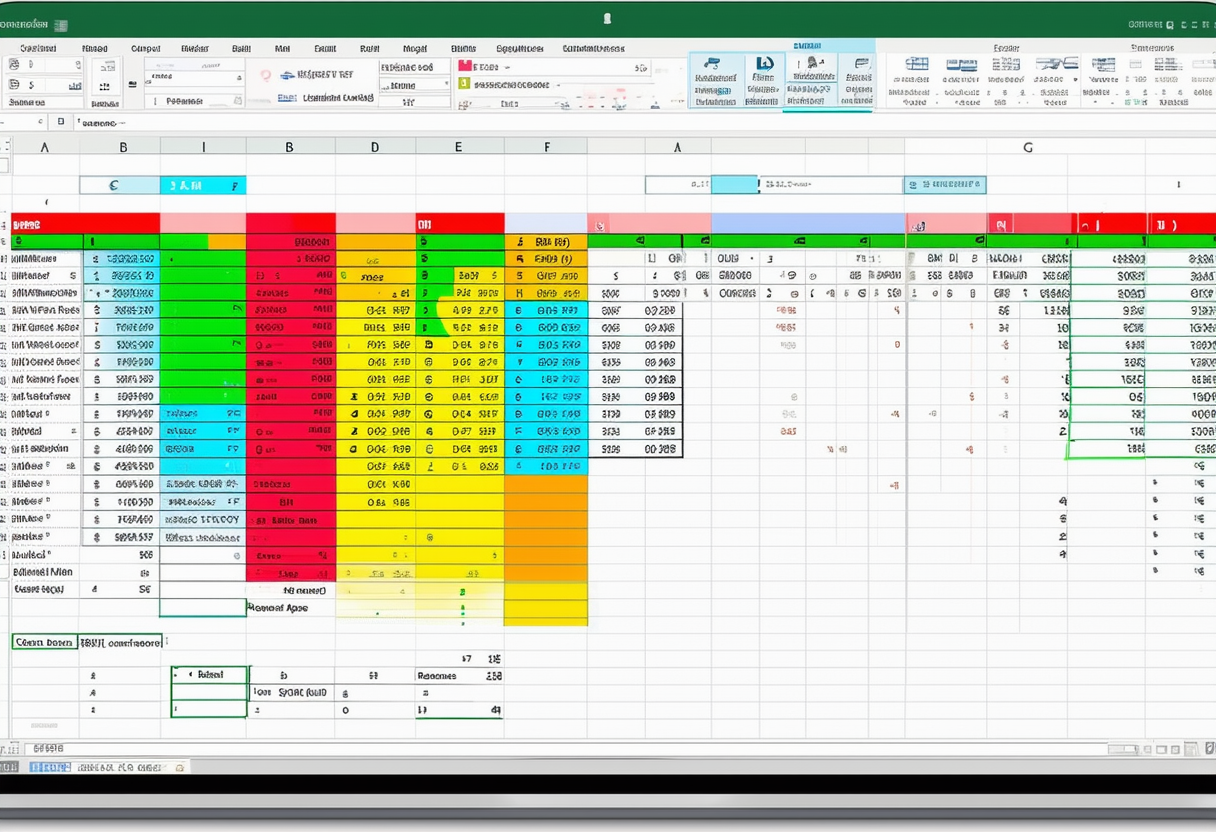

To create an effective budget in Excel, you can utilize formulas such as SUM to calculate your total income and expenses. By subtracting your expenses from your income, you can determine how much money you have available for savings or debt repayment. Additionally, you can use Excel’s conditional formatting feature to highlight areas where your spending exceeds your budgeted amounts, enabling you to make adjustments as needed.

Tracking Expenses with Excel Formulas

Excel offers various formulas that can help you track and categorize your expenses, making it easier to identify areas where you can cut back and save money. By using functions like SUMIF or SUMIFS, you can automatically calculate the total amount spent in different categories, such as groceries, entertainment, or utilities. This information can then be used to create visual representations of your spending patterns, allowing you to make more informed decisions about your budget.

Excel Formulas for Investment Analysis

Beyond budgeting, Excel can also be a powerful tool for analyzing and monitoring your investments. By utilizing specific formulas, you can evaluate the performance of your investments, calculate returns, and assess risks.

Calculating Returns on Investment in Excel

One of the most important aspects of investment analysis is determining the returns on your investments. With Excel’s formulas such as RATE, NPV, and IRR, you can calculate the rate of return on various investments, assess their profitability, and make informed decisions about where to allocate your funds.

Using Excel for Risk Assessment

Excel provides tools for analyzing the risks associated with different investment options. By utilizing formulas like STANDARD DEVIATION, you can measure the volatility of different assets and assess their suitability for your financial goals. Additionally, Excel’s charting capabilities allow you to visually represent the risk and return trade-offs, helping you choose investments that align with your risk tolerance.

Excel Formulas for Debt Management

Managing debt effectively is a crucial aspect of personal finance. Excel formulas can assist you in planning your debt repayment strategy and keeping track of interest rates.

Planning Debt Repayment with Excel

By utilizing Excel’s formulas, such as PMT (Payment), you can calculate the monthly payments required to pay off your debts within a specific timeframe. Furthermore, Excel’s data organization features allow you to visualize your debt repayment progress and make adjustments as needed. With proper debt management, you can reduce interest costs and accelerate your journey towards financial freedom.

Monitoring Interest Rates and Loan Terms

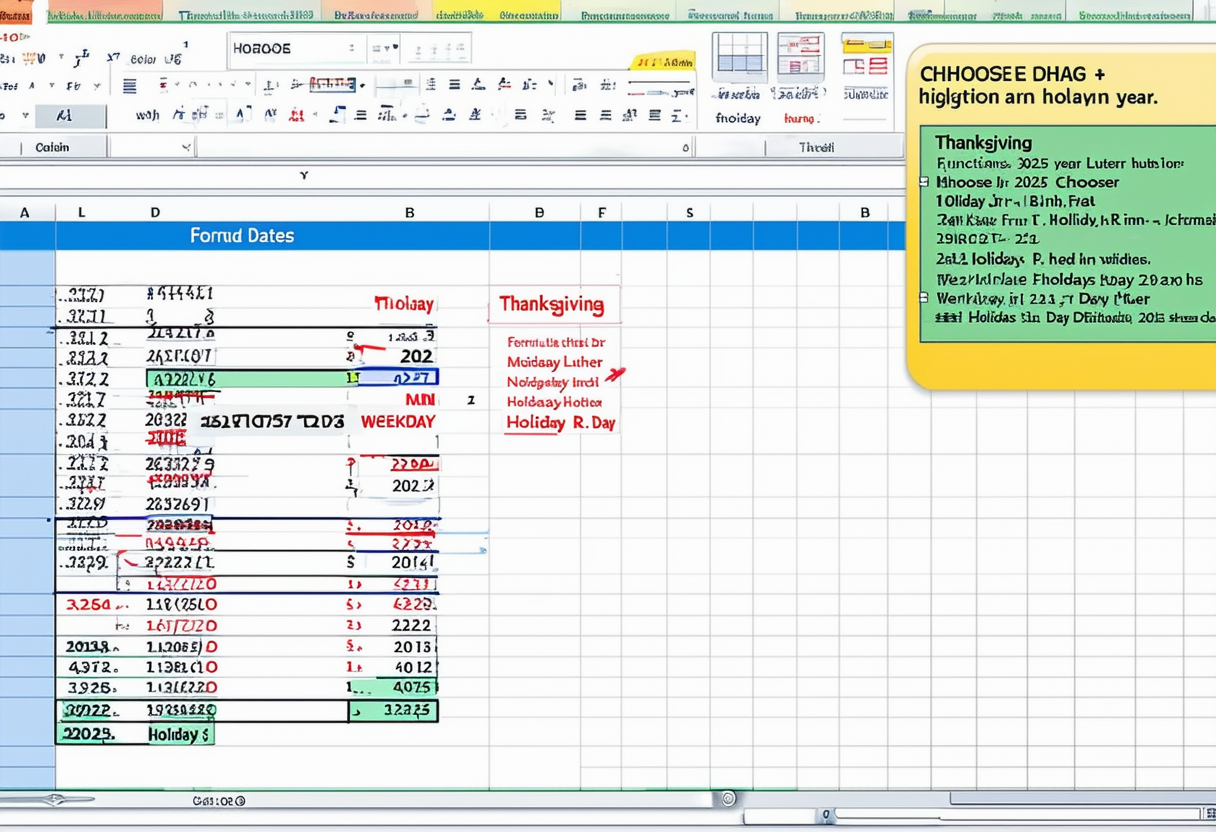

Excel’s data management capabilities enable you to track interest rates and loan terms associated with various debts. By using formulas like EFFECT, you can assess the true cost of borrowing and make informed decisions about refinancing or consolidating your debts. Excel’s ability to create tables and charts can help you monitor changes in interest rates and evaluate the impact on your monthly payments.

Excel Formulas for Retirement Planning

Planning for retirement is a critical aspect of personal finance. Excel provides formulas that can assist you in estimating your retirement savings and accounting for factors such as inflation and cost of living increases.

Estimating Retirement Savings in Excel

Utilizing Excel’s future value formulas, such as FV, you can estimate the value of your retirement savings based on factors like contribution amounts, investment returns, and time horizon. By adjusting these variables, you can gain insights into the impact of different scenarios on your retirement nest egg and make informed decisions about your savings strategy.

Planning for Inflation and Cost of Living Increases

Inflation and cost of living increases can erode the purchasing power of your retirement savings over time. Excel’s rate of return formulas and forecasting capabilities can help you account for these factors in your retirement planning. By adjusting assumptions and using formulas like RATE and FV, you can create a retirement plan that considers the potential impact of inflation, ensuring you maintain a comfortable standard of living throughout your golden years.

In conclusion, Excel is a powerful tool that can greatly enhance your ability to manage your personal finances effectively. By mastering the essential formulas outlined in this article, you can unlock the full potential of Excel and gain valuable insights into your income, expenses, investments, and retirement planning. Whether you’re a novice user or have some experience with spreadsheets, investing time in learning Excel for personal finance can pay dividends in helping you achieve your financial goals.