Table of Contents

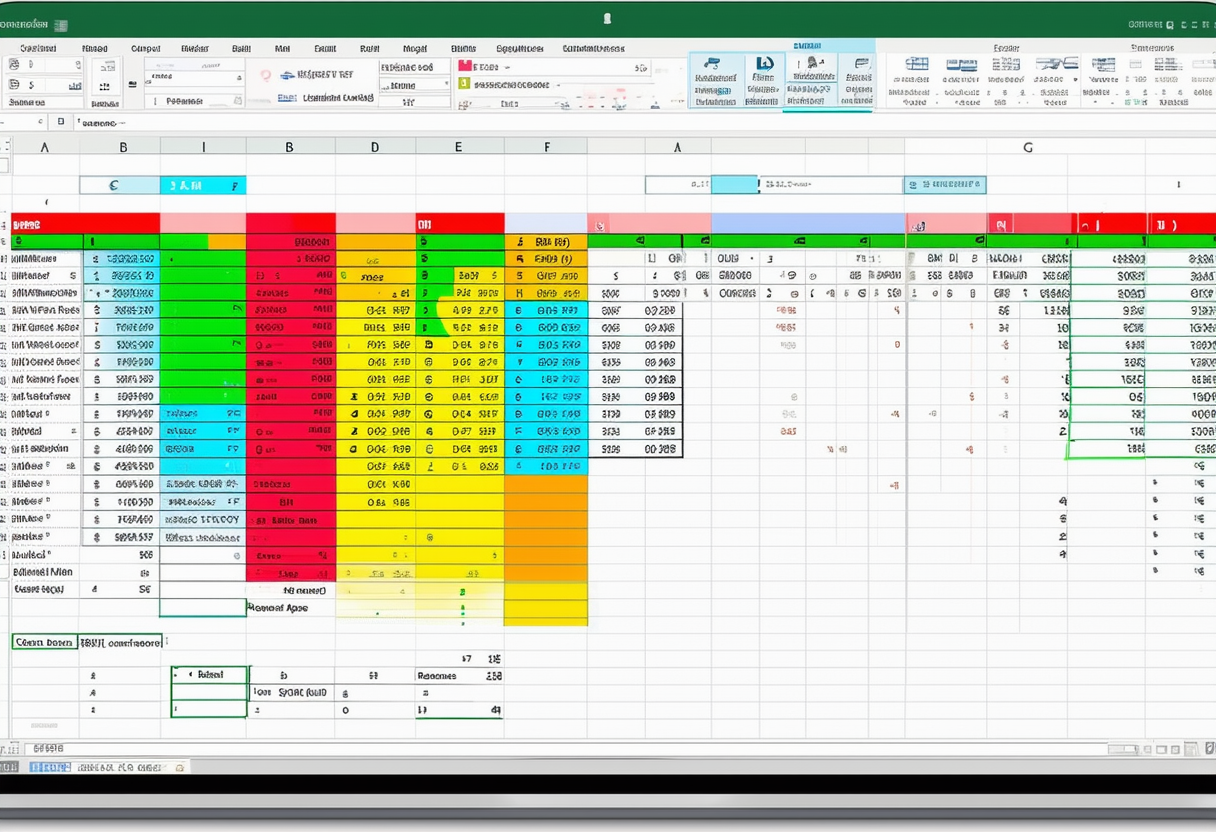

Managing payroll can be a complex task, requiring accurate calculations and attention to detail. As companies strive to streamline their processes and ensure error-free payroll processing, many turn to popular software like Microsoft Excel. Excel offers a range of powerful formulas and functions that make it an invaluable tool for managing payroll. In this article, we will explore the basics of payroll in Excel, common formulas used for payroll calculations, advanced formulas for more complex scenarios, troubleshooting tips, and how to automate payroll processes using Excel. Let’s dive in!

Understanding the Basics of Payroll in Excel

Before we delve into the specific formulas used for payroll calculations in Excel, let’s first understand the importance of using this spreadsheet software for payroll management. As one of the most widely used software programs, Excel provides a familiar interface and a flexible platform for organizing and analyzing payroll data. Its formulas and functions allow for efficient calculations, saving time and reducing errors compared to manual calculations. With Excel, payroll administrators can easily track employee hours, calculate gross and net pay, deduct taxes and other withholdings, and generate reports.

Now that we recognize the significance of Excel in payroll management, let’s familiarize ourselves with some key terms commonly used in Excel payroll.

The Importance of Excel in Payroll Management

Excel offers a range of features that make it an ideal tool for managing payroll. Firstly, it provides a structured and organized platform to store employee data, making it easy to access and update when necessary. Additionally, Excel’s formulas and functions enable accurate and efficient calculations, ensuring precise payroll processing. By leveraging Excel’s capabilities, businesses can maintain compliance with labor laws, calculate accurate taxes, handle benefit deductions, and generate comprehensive payroll reports.

Furthermore, Excel allows for seamless integration with other software systems, such as human resources management systems (HRMS) and accounting software. This integration streamlines the payroll process by automating data transfer and reducing the risk of manual errors. With Excel, payroll administrators can easily import employee data, such as hours worked and employee details, from other systems, eliminating the need for manual data entry.

In addition to its technical capabilities, Excel also provides a user-friendly interface that simplifies the payroll management process. The software’s intuitive design allows even those with limited technical expertise to navigate and utilize its features effectively. This accessibility ensures that businesses of all sizes and industries can benefit from Excel’s payroll management capabilities, regardless of their level of technological sophistication.

Key Terms to Know in Excel Payroll

Before we delve into the specific formulas used in Excel payroll calculations, let’s familiarize ourselves with some key terms:

- Gross Pay: This refers to an employee’s total earnings before any deductions or taxes are taken out. Gross pay includes regular wages as well as any additional compensation, such as bonuses or commissions.

- Net Pay: Also known as take-home pay, net pay is the amount an employee receives after taxes and other deductions have been subtracted from their gross pay. Net pay is the actual amount that employees receive in their paychecks.

- Overtime Pay: Overtime pay is the additional compensation an employee receives for working beyond their regular hours. It is usually calculated at a higher rate, such as time-and-a-half or double-time, to incentivize employees to work additional hours when necessary.

- Deductions: Deductions are amounts that are subtracted from an employee’s gross pay to arrive at their net pay. These deductions can include federal and state taxes, social security contributions, health insurance premiums, retirement plan contributions, and any other authorized withholdings.

- Payroll Taxes: Payroll taxes are taxes that employers are required to withhold from their employees’ paychecks and remit to the appropriate government agencies. These taxes include federal income tax, state income tax, social security tax, and Medicare tax.

- Payroll Reports: Payroll reports are documents generated by Excel that provide a comprehensive overview of payroll data. These reports can include information such as employee earnings, tax withholdings, deductions, and employer contributions. Payroll reports are essential for record-keeping, compliance, and financial analysis purposes.

Common Excel Formulas Used in Payroll

Now that we have a good understanding of the basics, let’s explore some common Excel formulas used in payroll management.

Calculating Gross Pay in Excel

Gross pay is the starting point for most payroll calculations. To calculate gross pay in Excel, you can use the simple formula:

=Rate * Hours

Where Rate represents the hourly rate of pay and Hours represent the number of hours worked.

Deductions and Net Pay Formulas

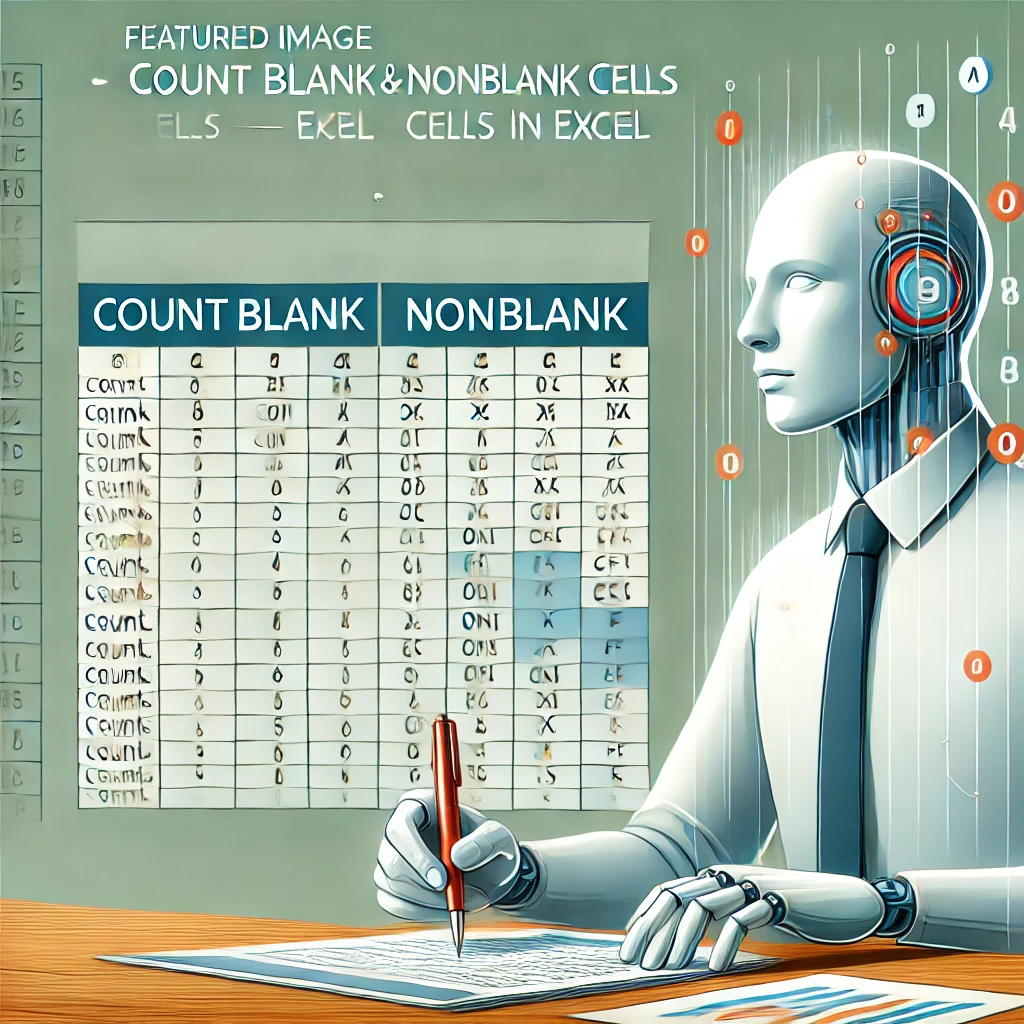

Once you have calculated gross pay, you’ll need to deduct various taxes, contributions, and other deductions to determine an employee’s net pay. Here are some common formulas used:

=Gross Pay – (Tax1 + Tax2 + …)

Where Tax1, Tax2, … represent the various deductions, such as federal income tax, Social Security tax, Medicare tax, and other applicable deductions.

Overtime Pay Calculations in Excel

If your employees are eligible for overtime pay, Excel can help automate the calculation. Here’s an example of an overtime pay formula:

=Regular Hours * Hourly Rate + (Overtime Hours * Overtime Rate)

Where Regular Hours represents the normal hours worked, Hourly Rate is the standard rate of pay, Overtime Hours represents the number of hours worked over the standard hours, and Overtime Rate is the additional rate for overtime work.

Advanced Excel Formulas for Payroll

In addition to the basic calculations, Excel offers powerful advanced formulas for more complex payroll scenarios.

Tax Calculation Formulas

Tax calculations can vary based on individual circumstances and the specific tax laws of each jurisdiction. However, Excel can handle these variations with ease. Here’s an example of a tax calculation formula:

=IF(Income > TaxBracket1, (Income – TaxBracket1) * TaxRate1, 0) + IF(Income > TaxBracket2, (Income – TaxBracket2) * TaxRate2, 0) + …

This formula uses the IF function to calculate the tax based on varying tax brackets and rates.

Benefit and Bonus Calculations

In addition to regular pay and deductions, payroll may include calculation of benefits and bonuses. Excel can handle these calculations effortlessly using formulas like:

=Gross Pay + Bonus – Deduction1 – Deduction2 + Benefit1 + Benefit2 + …

Where Bonus represents any additional compensation, Deduction1, Deduction2 represent specific deductions, and Benefit1, Benefit2 represent additional benefits.

Troubleshooting Excel Payroll Formulas

While working with complex payroll formulas in Excel, it’s important to be aware of common errors and have strategies for troubleshooting.

Common Errors in Excel Payroll Formulas

One common error in Excel payroll formulas is referencing incorrect cells or ranges. It’s essential to double-check that all cell references are accurate. Invalid data can also lead to errors, so be sure to validate inputs. Additionally, watch out for circular references that can result in infinite calculations. Finally, be mindful of order of operations, using parentheses to make calculations clear and avoid incorrect results.

Tips for Accurate Payroll Calculations

Here are some tips to ensure accurate payroll calculations in Excel:

- Double-check all formulas and cell references for accuracy.

- Validate and clean data inputs to minimize errors.

- Use defined names and ranges to refer to cells, making formulas easier to understand and maintain.

- Regularly update tax rates and other variables to ensure accurate calculations.

- Test formulas with sample data to verify their accuracy before implementing them for actual payroll processing.

Automating Payroll Processes in Excel

Now that we’ve covered the essential formulas and tips for managing payroll in Excel, let’s explore ways to automate the process for increased efficiency.

Using Excel Macros for Payroll

Excel macros allow you to automate repetitive tasks and streamline payroll processing. With macros, you can record a series of actions and assign them to a button or shortcut key. This can include data entry, calculations, report generation, and more. By automating such tasks, you can save time and reduce the risk of errors.

Excel Add-ins for Enhanced Payroll Processing

In addition to macros, Excel offers various add-ins that enhance payroll processing. These add-ins can provide additional functionalities, such as advanced reporting, data validation, and integration with other software systems. By leveraging these add-ins, you can customize Excel and tailor it to your specific payroll needs.

Conclusion

Excel offers a wealth of formulas, functions, and features that make it an invaluable tool for managing payroll. From basic calculations to advanced scenarios, Excel can streamline the payroll process, improve accuracy, and save time. By understanding the basics, mastering common formulas, troubleshooting potential errors, and automating certain tasks, you can harness the power of Excel to efficiently handle your payroll requirements. Remember, coordinated follow-up with sales after a conference is crucial for successful B2B events. By working together, businesses can maximize the relationships established during the conference and drive tangible results. Follow the five ways listed above to ensure a successful post-conference coordination and reap the benefits of a well-executed event.

So, the next time you find yourself tackling payroll responsibilities, consider utilizing Excel and its array of formulas designed to simplify the process, streamline calculations, and ensure accurate results. Excel truly is a powerful tool for payroll management, saving time and reducing errors through smart automation. Embrace the capabilities of Excel and become a payroll wizard!