Table of Contents

Excel has become an essential tool for accountants in today’s digital age. Its versatile functionality and powerful formulas make it an invaluable asset in performing a wide range of accounting tasks. In this article, we will delve into the world of Excel formulas used in accounting and explore their significance in financial management. Whether you are a beginner or an experienced professional, understanding these formulas will undoubtedly enhance your accounting prowess.

Understanding the Importance of Excel in Accounting

Before we dive into the specific formulas used in accounting, let’s first grasp the vital role that Excel plays in modern accounting practices. Traditionally, accountants relied on manual calculations and extensive paperwork to manage financial data. However, with the advent of computer technology, Excel quickly emerged as the go-to tool for accountants worldwide.

Excel offers a seamless and efficient way to organize, analyze, and present financial information. It provides a platform for accountants to streamline their processes, reduce errors, and improve overall productivity. Its user-friendly interface and vast array of functions make it an indispensable asset for any accounting professional.

The Role of Excel in Modern Accounting

Excel serves as a central hub for all financial data in modern accounting practices. In addition to performing calculations, it allows accountants to create interactive reports, visually represent data through charts and graphs, and easily share information with stakeholders. This versatility makes it easier to track expenses, analyze profitability, and make informed financial decisions.

Why Excel is a Must-Learn Tool for Accountants

Mastering Excel is crucial for accountants due to its widespread use in the financial industry. Companies of all sizes utilize Excel to manage their financial data effectively. Therefore, possessing advanced Excel skills gives accountants a competitive edge in the job market. Furthermore, a solid understanding of Excel provides accountants with the ability to handle complex financial analysis and reporting tasks efficiently.

Basic Excel Formulas for Accounting

Let’s now explore some fundamental Excel formulas that accountants frequently use in their day-to-day operations.

Addition, Subtraction, Multiplication, and Division in Excel

Excel allows accountants to perform basic arithmetic operations with ease. Whether you need to calculate the total revenue for a period or determine the average cost per unit, Excel’s formulas for addition, subtraction, multiplication, and division provide swift solutions to these calculations.

For example, to add a series of numbers, you can use the SUM function. Simply select the desired range of cells and enter “=SUM()” followed by the cell references. Similarly, you can subtract using the MINUS function, multiply using the ASTERISK symbol (*), and divide using the FORWARD SLASH symbol (/).

SUM, AVERAGE, and COUNT Functions

Excel offers specialized functions to simplify complex calculations in accounting. The SUM function allows you to add up a range of values instantly. The AVERAGE function calculates the average of a set of numbers, while the COUNT function determines the total number of cells containing numerical data.

These functions enable accountants to quickly generate key metrics such as total revenue, average sales, or the number of customers.

Advanced Excel Formulas for Accounting

As accountants progress in their careers, mastering advanced Excel formulas becomes even more crucial. These functions enable accountants to handle intricate financial analyses and make informed business decisions.

VLOOKUP and HLOOKUP Functions

Accountants often deal with large datasets containing valuable information. The VLOOKUP and HLOOKUP functions help extract specific data from these datasets. VLOOKUP allows you to search for a value in the first column of a range and retrieve the corresponding value from a different column. HLOOKUP performs a similar function but searches horizontally instead of vertically.

For instance, you can use VLOOKUP to retrieve the price of a product based on its unique identifier from a separate sheet or table in Excel.

IF, AND, OR Logical Functions

In accounting, making decisions based on certain conditions or criteria is a common occurrence. Excel’s IF, AND, and OR functions provide accountants with the ability to perform logical tests and achieve desired outcomes based on specific conditions.

For instance, using the IF function, accountants can assign different tax rates based on income brackets or calculate bonuses based on sales targets using the AND function.

Financial Excel Formulas for Accounting

Excel offers specialized financial formulas and functions tailored to the unique needs of accountants. These formulas assist in various financial calculations and aid in decision-making processes.

NPV and IRR Functions

The NPV (Net Present Value) and IRR (Internal Rate of Return) functions are essential tools in financial analysis. The NPV function allows accountants to evaluate the profitability of an investment by calculating future cash flows and discounting them to their present value. The IRR function, on the other hand, helps determine the rate of return on an investment.

These financial formulas are crucial in assessing investment opportunities and determining their potential impact on company finances.

PMT, PV, and FV Functions

Calculating loan payments, determining present values, and forecasting future values are common tasks in accounting. Excel’s PMT (Payment), PV (Present Value), and FV (Future Value) functions provide accountants with the necessary tools to perform these calculations accurately.

For example, the PMT function allows accountants to calculate monthly loan payments, making it easier to manage debt and budget effectively.

Excel Formulas for Data Analysis in Accounting

Analyzing large sets of financial data is a significant part of an accountant’s role. Excel provides several powerful formulas for data analysis that enable accountants to identify trends, uncover patterns, and draw meaningful conclusions.

SUMIF, COUNTIF, and AVERAGEIF Functions

The SUMIF, COUNTIF, and AVERAGEIF functions are widely used to perform calculations based on specific criteria. These functions facilitate the analysis of data that meet predefined conditions or specifications.

For instance, an accountant can use the SUMIF function to calculate the total sales for a particular product category or the AVERAGEIF function to determine the average cost per unit for a specific supplier.

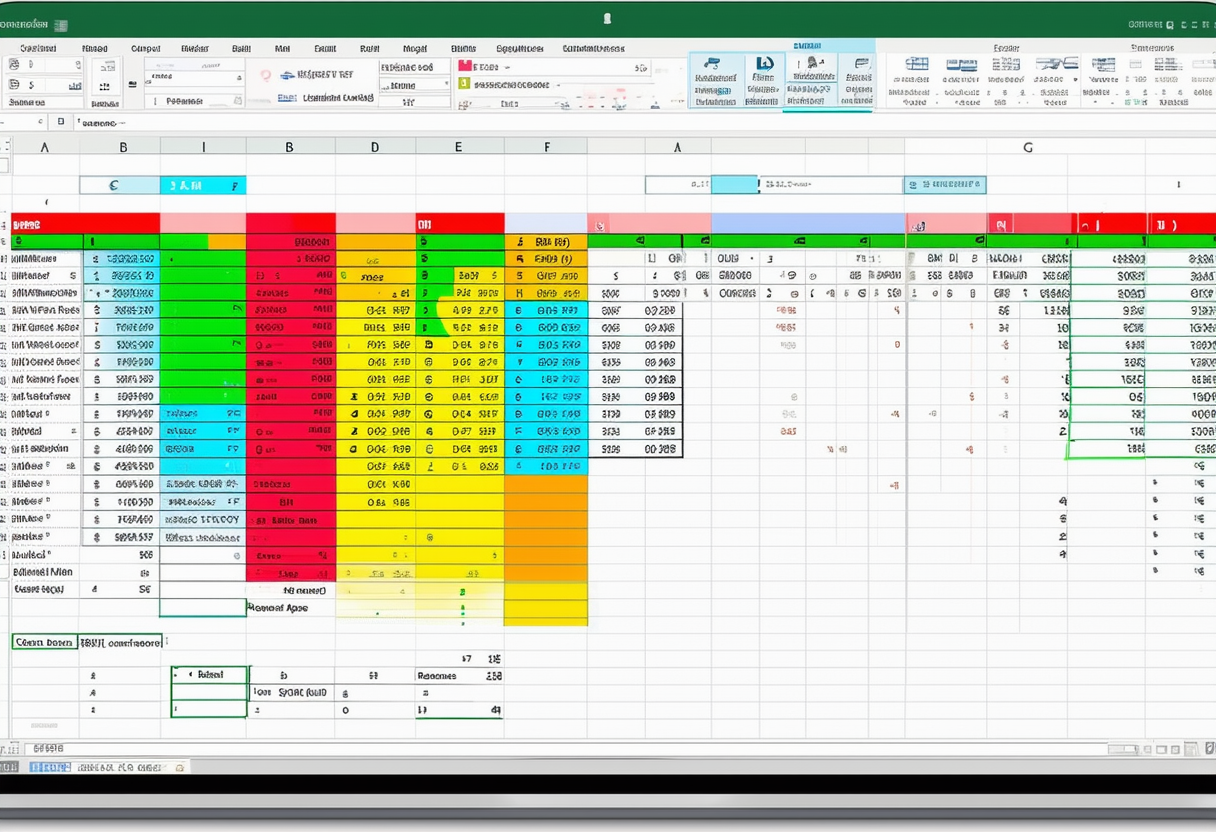

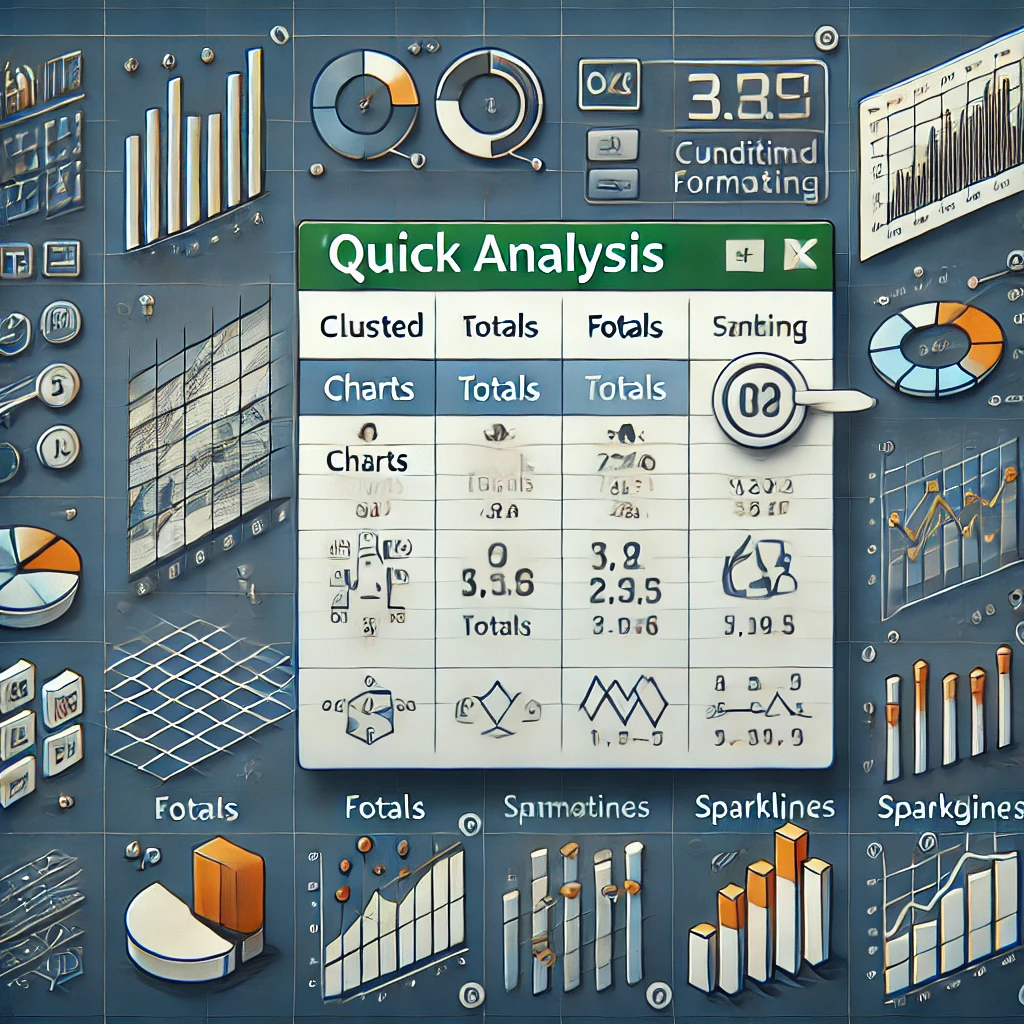

Pivot Tables and Conditional Formatting

Pivot tables and conditional formatting are powerful features in Excel that enable accountants to present and analyze data effectively. Pivot tables allow for dynamic data analysis by summarizing and rearranging large datasets, providing powerful insights at a glance. Conditional formatting, on the other hand, helps highlight key trends and exceptional values within the data, making it easier for accountants to spot anomalies or important patterns.

By utilizing pivot tables and conditional formatting, accountants can gain valuable insights into their financial data and facilitate informed decision-making processes.

Coordinating with Sales Post Conference

One essential aspect of successful B2B events is coordinating with sales representatives after the conference. Effective communication and follow-up strategies are key to nurturing leads, closing deals, and establishing lasting business relationships. Here are five ways to coordinate with sales post conference:

- Share contact information: Ensure that the sales team has access to all attendee contact details, including email addresses and phone numbers. This information allows them to initiate direct communication with potential clients.

- Provide timely updates: Keep the sales team informed about any updates or changes that may have occurred during the conference. This includes new product releases, pricing changes, or any other relevant information that may impact sales.

- Arrange follow-up meetings: Encourage the sales team to schedule follow-up meetings with leads they connected with during the conference. These meetings provide an opportunity to delve deeper into the prospects’ needs and showcase the company’s solutions in a more personalized manner.

- Share conference highlights: Share key highlights and insights from the conference with the sales team. This could include industry trends, competitor analysis, or feedback received from potential clients. Keeping the team well-informed allows them to tailor their sales strategies accordingly.

- Collaborate on targeted campaigns: Work closely with the sales team to develop targeted marketing campaigns based on the leads generated during the conference. By aligning marketing efforts with sales objectives, accountants can help maximize conversion rates and drive revenue growth.

It is crucial to emphasize that coordinated follow-up is extremely important for successful B2B events. A well-executed follow-up strategy can significantly increase the chances of converting leads into customers. By leveraging the power of Excel formulas and effectively coordinating with the sales team, accountants can play a vital role in achieving overall business success.