Table of Contents

Retirement planning is a crucial step towards securing a financially stable future. With the right tools and strategies in place, you can ensure that you are well-prepared for your golden years. One such tool that can greatly assist you in this endeavor is Excel, a versatile spreadsheet program that provides various features to help you maximize your retirement planning. In this article, we will explore the importance of retirement planning, the role of financial management in retirement, and why Excel is an ideal choice for this purpose. We will also delve into getting started with Excel for retirement planning, key components of a retirement plan in Excel, advanced Excel techniques, and how to efficiently maintain and update your retirement plan.

Understanding the Importance of Retirement Planning

Retirement planning goes beyond just setting aside money for the future. It involves carefully evaluating your financial goals, estimating future expenses, and determining how to create a sustainable income stream during retirement. By planning ahead, you can ensure a comfortable retirement and eliminate any financial uncertainties that may arise.

Retirement planning also allows you to make informed decisions about your investments, ensuring that your money works for you over the long run. It provides a roadmap to achieve your desired financial freedom and maintain your current lifestyle even after leaving the workforce.

The Role of Financial Management in Retirement

Financial management plays a vital role in retirement planning. It involves assessing your current financial situation, understanding your sources of income, and identifying potential areas for improvement. By managing your finances effectively, you can optimize your savings, track your expenses, and align your investments with your retirement goals.

Proper financial management also enables you to stay on track with your retirement plan and make adjustments as needed. It allows you to maintain a clear overview of your income, expenses, and investments, ensuring that you are on the right path towards your retirement goals.

Why Use Excel for Retirement Planning?

Excel offers a multitude of features that make it an invaluable tool for retirement planning. Its flexibility and powerful calculations capabilities allow you to create customized spreadsheets to suit your specific needs.

One of the main advantages of using Excel for retirement planning is its ability to perform complex calculations effortlessly. From projecting your income over several years to forecasting your expenses, Excel streamlines the process and provides accurate results. Its built-in functions for financial calculations, such as compound interest and future value, make it a reliable choice for retirement planning.

Additionally, Excel’s graphical capabilities make it easy to visualize your retirement plan. With intuitive charts and graphs, you can monitor the growth of your investments, track your progress, and identify areas where adjustments may be necessary. This visual representation adds clarity and enhances your understanding of your retirement plan.

Getting Started with Excel for Retirement Planning

Before diving into the intricacies of retirement planning with Excel, it is essential to have a basic understanding of how to use the program. Familiarizing yourself with Excel’s key functions and tools will enable you to make the most of its features for your retirement planning endeavors.

Basic Excel Skills for Financial Planning

Start by learning the fundamental Excel functions, such as creating and formatting spreadsheets, entering data, and navigating between cells. Understanding how to use formulas, such as sum, average, and max, will help you perform quick calculations and analyze your financial data effectively.

Additionally, familiarize yourself with data validation, conditional formatting, and sorting and filtering techniques to maintain a structured and organized spreadsheet for your retirement plan.

Setting Up Your Retirement Planning Spreadsheet

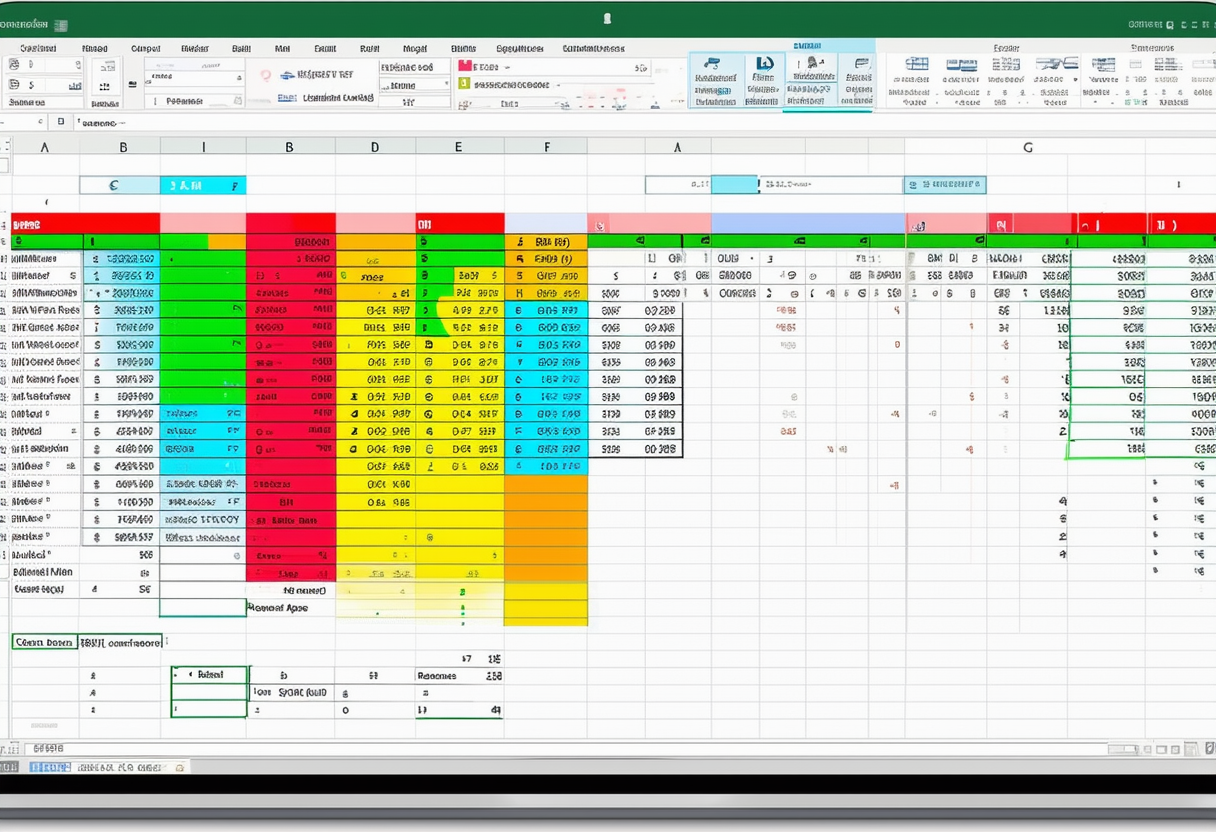

When setting up your retirement planning spreadsheet, carefully consider the information you want to track and analyze. Create different sections for income, expenses, investments, and projections. Use clear and concise labels for each column and row to ensure easy comprehension.

Furthermore, utilize Excel’s features for conditional formatting and data validation to highlight important information and prevent errors in your spreadsheet. Implementing well-defined data ranges and drop-down menus will ensure the accuracy and integrity of your retirement planning data.

Key Components of a Retirement Plan in Excel

An effective retirement plan in Excel consists of various key components that help you analyze and strategize your financial journey towards retirement. These components include income projection, expense forecasting, and investment tracking. By diligently monitoring these factors, you can make informed decisions and stay on track with your retirement goals.

Income Projection in Excel

To create an income projection in Excel, start by listing your anticipated income sources during retirement. This may include pensions, social security benefits, annuities, and other investments. Once you have identified these sources, input the corresponding values into your spreadsheet and utilize Excel’s financial functions to calculate the projected income over the desired period.

Regularly updating your income projection, taking into account any changes in your financial situation, will provide you with a realistic outlook on your retirement finances and allow you to adjust your saving and investment strategies accordingly.

Expense Forecasting in Excel

Accurately forecasting your expenses is crucial for a well-rounded retirement plan. Start by categorizing your expenses into different areas such as housing, healthcare, transportation, and leisure activities. Determine the estimated costs for each category and input the values into your spreadsheet.

Use Excel’s built-in functions to calculate the total expenses for each period and compare them with your projected income. This will give you an overview of your cash flow and help you identify areas where you may need to adjust your spending habits or find ways to reduce costs.

Investment Tracking in Excel

Investment tracking is a vital aspect of retirement planning, as it enables you to monitor the performance of your investments and evaluate whether they align with your financial goals. In your Excel spreadsheet, create a section dedicated to tracking your investments, including the type of investment, initial investment amount, and expected returns.

Regularly update the values in your investment tracking sheet to reflect any changes in market conditions or investment performance. This will allow you to make informed decisions about rebalancing your portfolio and adjusting your investment strategy as needed.

Advanced Excel Techniques for Retirement Planning

Once you have mastered the basics of Excel for retirement planning, you can explore more advanced techniques to enhance your financial analysis and decision-making process.

Using Excel Formulas for Financial Calculations

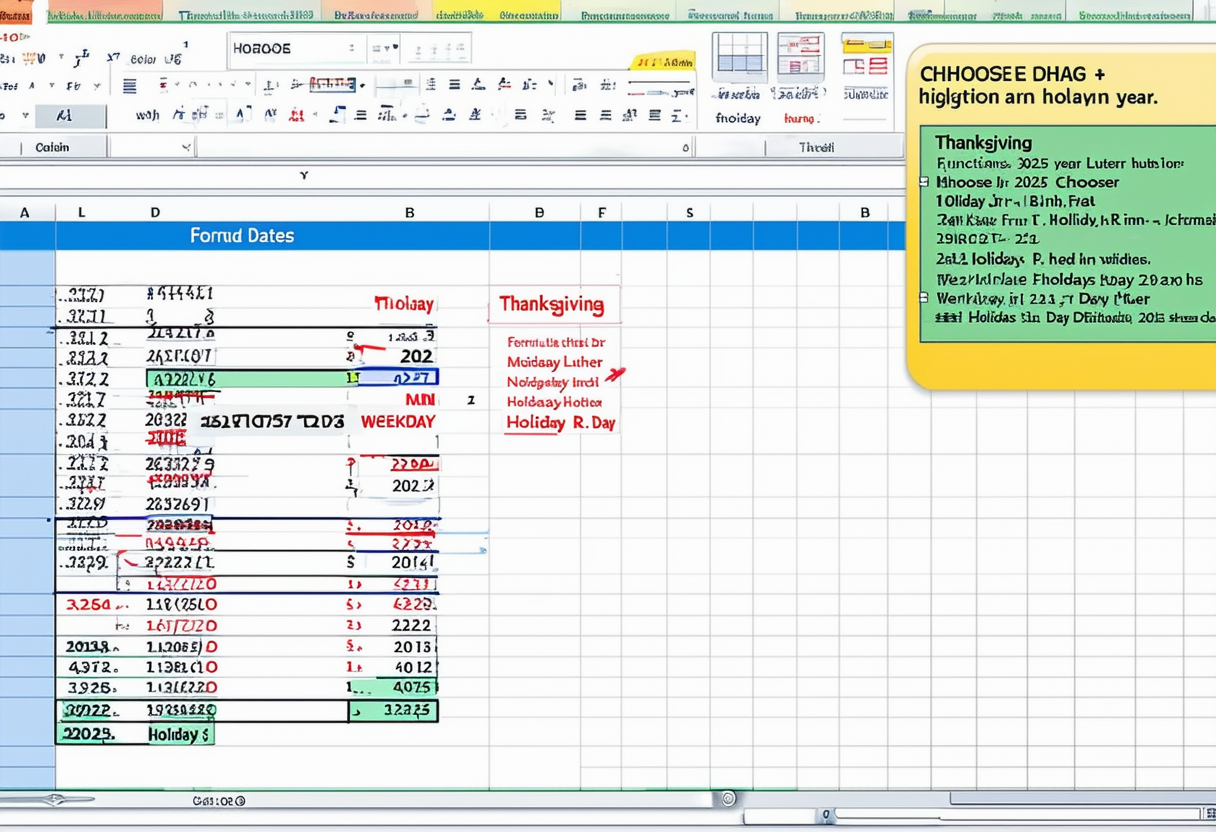

Excel offers a wide range of formulas that can streamline your financial calculations and enable you to perform complex analyses effortlessly. For example, you can use the PMT function to calculate future savings based on a fixed interest rate and regular contributions. Excel’s goal-seeking feature can help you determine the necessary savings amount to achieve a specific retirement goal.

By utilizing formulas such as IF, VLOOKUP, and HLOOKUP, you can create dynamic spreadsheets that automate repetitive tasks and provide you with real-time results. Excel’s Solver add-in can also be employed to optimize your retirement plan and find the best possible solution based on specific constraints and goals.

Visualizing Your Retirement Plan with Excel Charts

Excel’s charting capabilities allow you to visually represent your retirement plan, making it easier to interpret and analyze the data. Create charts to showcase your income projection, expense forecast, and investment performance. Choose the appropriate chart type, such as line charts or bar graphs, to effectively convey your financial information.

Additionally, utilize Excel’s formatting options to enhance the visual appeal of your charts. Add titles, labels, and legends to provide context and improve readability. By visually representing your retirement plan, you can better understand the trends and patterns in your financial data and make informed decisions accordingly.

Maintaining and Updating Your Retirement Plan in Excel

Once you have established your retirement plan in Excel, it is crucial to regularly review and update it to ensure its relevance and accuracy.

Regularly Reviewing Your Retirement Plan

Set a schedule to review your retirement plan periodically. This may be quarterly, semi-annually, or annually, depending on your preferences. During these reviews, evaluate your progress towards your goals, reassess your income and expense projections, and make any necessary adjustments to your investment strategy.

During the review process, take into account any life changes that may impact your retirement plan. This includes factors such as career transitions, changes in family circumstances, or unexpected expenses. By regularly reviewing your retirement plan, you can adapt to these changes and ensure your plan remains on track.

Adjusting Your Plan for Life Changes

Life is dynamic, and circumstances may change over time. It is essential to revise your retirement plan in Excel to reflect any significant changes in your life. For example, if you experience a salary increase or decrease, adjust the income projection accordingly. Similarly, if you plan to downsize or upgrade your living arrangements, update the expense forecast to reflect the new circumstances.

Regularly adjusting your retirement plan will enable you to maintain a realistic outlook on your financial journey and make necessary amendments to secure a comfortable retirement.

In Conclusion

Retirement planning is a critical aspect of securing a financially stable future. By utilizing Excel’s powerful features and functions, you can streamline your retirement planning process and ensure maximum efficiency. From creating personalized spreadsheets to projecting income, forecasting expenses, and tracking investments, Excel provides a comprehensive toolkit for retirement planning.

Remember to maintain and update your retirement plan regularly, taking into account any life changes and adjustments needed to stay on track. By utilizing Excel’s capabilities for financial calculations and data visualization, you can gain deeper insights into your retirement plan and make informed decisions towards achieving your retirement goals. Start maximizing your retirement planning with Excel today and enjoy the benefits of a secure and prosperous future.